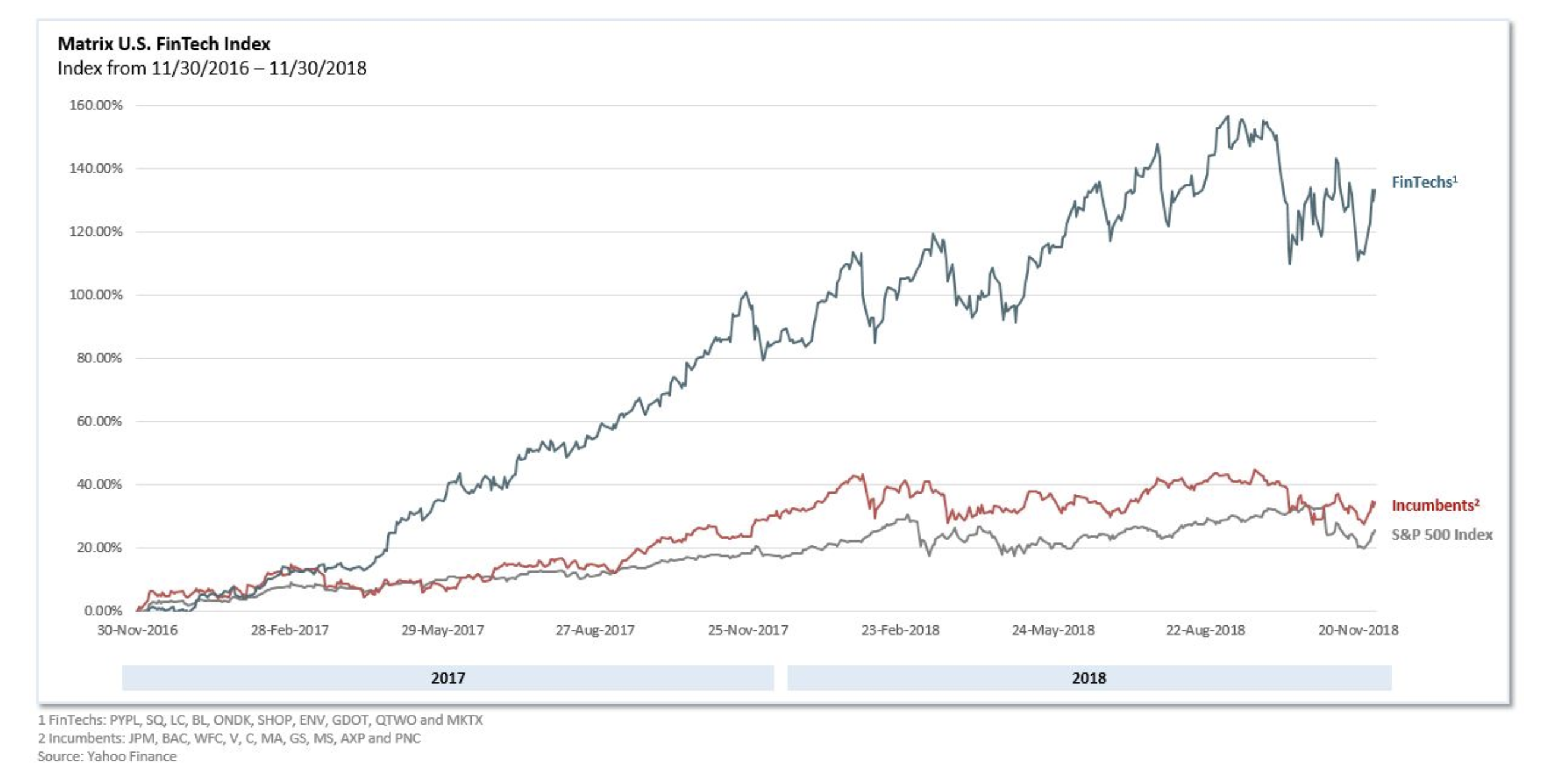

This time last year, the crypto bull market stole the spotlight. In the midst of bitcoin’s wild run, we announced the Matrix FinTech Index in recognition of the top 10 publicly traded U.S. fintechs quietly surpassing $100 billion in total market capitalization. We predicted that in 2018, the fintechs would prove to be the more relevant disruptors and their equity value would continue to outpace the incumbents.

As we look back, this prediction proved to be true. The market cap of the Matrix FinTech Index grew 50 percentage points in 2018, far outpacing the incumbent financial service giants and the S&P 500. Looking ahead to 2019, we predict that the fintechs will continue to steal the show—creating innovative tech-enabled products, providing access to underserved demographics, and putting consumers first.

The FinTech Index continues to outperform in 2018, though volatility has increased

In this 2018 year-end edition of the Matrix FinTech Index[1] , we are excited to provide a refreshed view of last year’s index. As a quick reminder, the index is a market-cap weighted index that tracks the progress of a portfolio of 10 leading public fintech companies. For comparison, we also included another portfolio of 10 large financial services incumbents (companies like JP Morgan and Visa), as well as the S&P 500. In 2018, the total market cap of the top 10 publicly traded U.S. fintechs grew to nearly $170B and the 2-year returns of the fintechs are now at 133%–100 percentage points higher than the 2-year returns for the incumbents.

Definition: Matrix Partners considers “fintechs” to be venture-backed organizations that are (a) technology-first companies that leverage software to compete with traditional financial services institutions (e.g. banks, credit card networks, insurers, etc.) in the delivery of traditional financial services (e.g. lending, payments, investing, etc.) or (b) software tools that better enable traditional finance functions (e.g. accounting, point-of-sales systems, etc.)

Compared to 2017, volatility increased in 2018. While part of this is the broader state of the equity markets in 2018, it’s worth noting a few specific headwinds (e.g. the TIO security breach that impacted PayPal, Amazon launching Amazon Pay) as well as a few general macro concerns like rising interest rates. But looking ahead to 2019, all 10 of the publicly traded fintechs are expected to continue to have double-digit growth. The only incumbents expected to squeak into double-digit territory in 2019 are card issuers like Visa (11%) and Mastercard (13%) –enabled, in part, by the growth of fintech payment companies like Square and PayPal.

2019 Prediction: The Matrix FinTech Index will deliver 200% returns over the three years ending in December of 2019, outperforming the incumbents and S&P 500 by at least 150 percentage points.

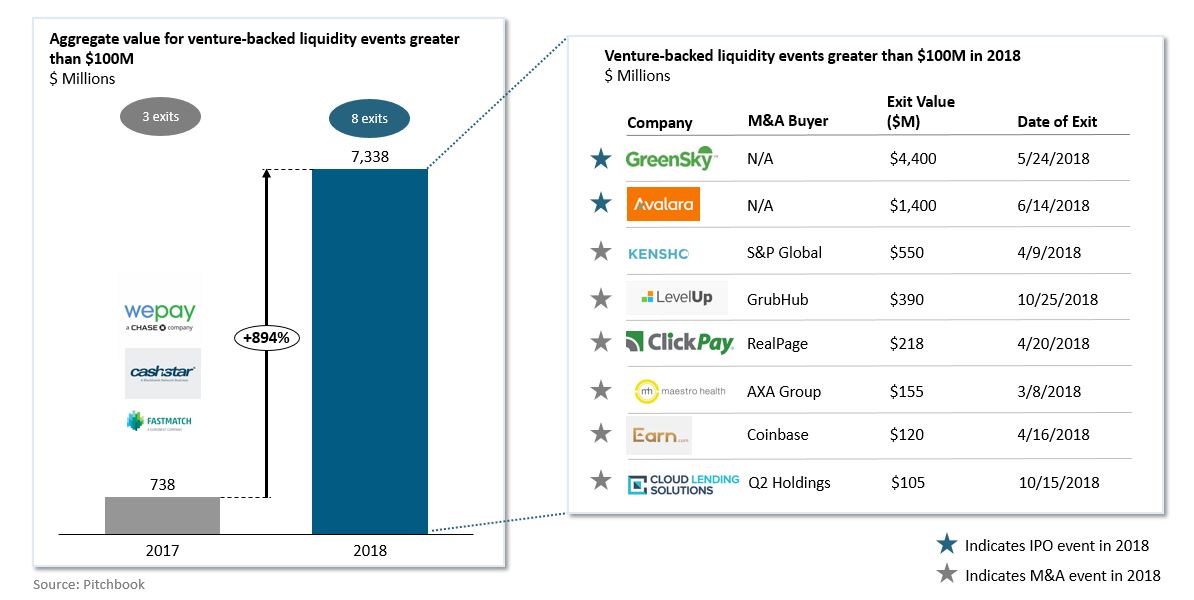

Liquidity is starting to trickle in for private fintech companies

While the FinTech Index performed well on the public markets in 2018, we also saw some very promising liquidity events for privately held companies. In 2017, there were only 3 fintech exits in the U.S. over $100M, totaling just over $700M in value. In 2018 that number grew by a factor of 10 to over $7B in value. More than half of that value came from the GreenSky IPO, but there were also a number of significant M&A events. We expect M&A activity to increase as financial services incumbents acquire fintech companies in an effort to stay competitive. And we continue to believe that the fintech sector will prove to be one of the most fruitful sectors for venture returns in the 15 years following the 2008 financial crisis.

2019 Prediction: Total aggregate value for fintech liquidity events will exceed $10B in one year for the first time ever.

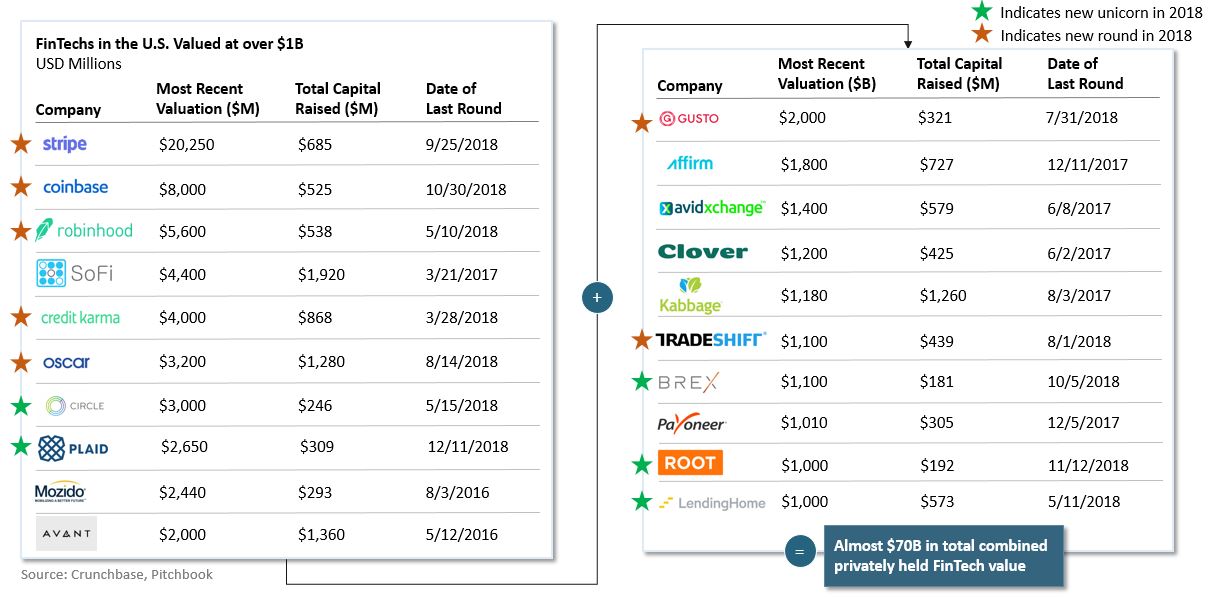

The fintech unicorn pipeline is primed for some big outcomes

What’s even more exciting than 2018’s liquidity is the backlog of privately held fintechs, led by Stripe, that are valued at over $1B. There are now 20 fintech unicorns. In fact, there are more fintech unicorns than any other industry vertical in the Unicorn Club. More than 50% of these raised big growth rounds in 2018 and five of them (Circle, Plaid, Brex, Root and LendingHome) made their debut on the U.S. fintech unicorn list for the first time. The expansion of this list shows that there is no shortage of high-potential areas to disrupt in financial services.

2019 Prediction: Total aggregate value for fintech unicorns will cross $90B and the total number of fintech unicorns will begin to close in on 30.

The next wave of value creation from younger fintechs will be even bigger than the first

Despite these successes on the public markets, in liquidity events and among the unicorn ranks, we are still in the very early innings of the fintech revolution. 2019 will be even more impressive than 2018 as there are an additional 40 U.S. fintechs that have raised more than $100M in equity funding and are on the brink of entering the unicorn club. As many of these companies make that transition, they will sprout another wave of more interesting fintech companies as early employees go on to start their own companies in a virtuous wave of value creation.

We expect these newcomers, and others aspiring to follow in their footsteps, will threaten to end the rule of the financial establishment. They will continue to offer better financial products to consumers, empower more efficient payment channels, and create a more open financial system. At the same time, the incumbents will continue to struggle with innovation, hamstrung by their scale, regulatory burdens, and decades of accumulated technical debt.

Make no mistake. What new fintech companies are attempting is very ambitious and incredibly difficult to achieve. The existing ecosystem of incumbent providers dates back 150 years and represents some of the largest global financial institutions. That said, digital transformation is afoot and the financial service industry will not be spared.

from TechCrunch https://tcrn.ch/2GMEgpT

via IFTTT

Comments

Post a Comment