Màrius Montmany and Oriol Hernandez i Fajula, former employees at large logistics companies, several years ago found themselves frustrated with the problem of “reverse logistics” — how to get product returns through the mail system in an efficient and cost-effective way.

Dissatisfied with the existing solutions out there, the pair founded Rever — now backed by Y Combinator — in 2022. Rever offers instant cash refunds through a buy now, pay later-type (BNPL) model (Rever finances the transactions), automating the processes of label generation and refunds while providing analytics on customer behavior and purchasing trends.

“Rever stands out as [an] all-in-one platform that combines fintech, logistics, software, and customer service specifically designed for e-commerce returns,” Montmany told TechCrunch in an email interview. “Rever’s technology provides concrete business benefits, making it a valuable investment for enterprises seeking to optimize their e-commerce operations and improve their bottom line.”

Is Rever actually a “valuable investment” that helps improve bottom lines? Perhaps.

One recent study found that roughly 10% of purchases are returned, adding up to billions of dollars a year — with online returns predictably higher than in-store. And the problem is worsening. In 2021, the value of merchandise returned to retailers hit $761 billion, up around 78% from 2020.

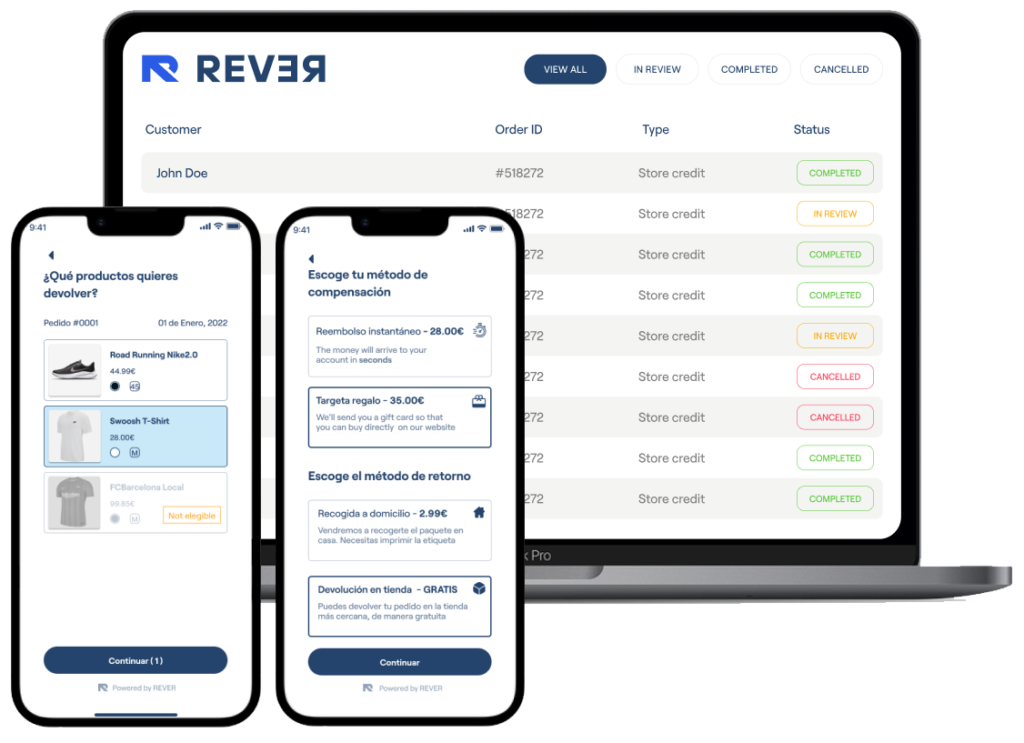

Montmany claims that Rever can minimize these costs through its differentiated feature set. For example, the platform provides tools to streamline operations and automate various shipping logistics processes (e.g. generating shipping labels and tracking shipped packages). And Rever’s shopping recommendations aim to keep even shoppers who ultimately return items on the retailer’s website.

On the backend, Rever tracks the status of each return, manages customer complaints and delivers real-time data on return requests, refunds and exchanges.

Image Credits: Rever

“We are actively developing an AI-powered functionality that suggests alternative products based on customers’ previous purchases and preferences,” added Montmany. “This exciting feature is set to launch later this year, further personalizing the shopping experience.”

There’s something to be said for the impact of an easy returns process on brand perception, certainly. According to a 2022 Narvar survey, 96% of customers would buy again from a business that provides a “very easy” or “easy” return policy — and 77% say that instant refunds are their favorite benefit.

Rever, which has around 25 employees currently, claims to have over 130 customers and “positive unit economics.” While that’s impressive momentum in just a year, the question is whether it can beat back rivals in a sector that’s becoming increasingly competitive.

Rever sees Shopify and BNPL player Klarna as its chief rivals as well as return-focused startups Loop Returns, ReturnLogic and Sendcloud, some of which also offer instant cash refunds. It’s a lot of vendors to combat. But if Montmany has concerns, he didn’t share them, insisting that Barcelona-based Rever has a “sustainable business model with a long runway.”

To wit, Y Combinator-backed Rever recently closed a €8.5 million (~$9.29 million) million funding round led by GFC and Oscar Pierre, which the company plans to put toward expansion, hiring and eventually expanding beyond product returns.

“The pandemic has had a positive impact on Rever’s business,” he said. “With ecommerce penetration increasing by up to 10x in some European countries and return rates doubling, the market for Rever’s services has grown significantly. Moreover, during economic downturns, solving returns becomes a priority for ecommerce brands, leading to increased interest in Rever’s solutions worldwide, especially during peak seasons like summer sales or Black Friday.

Y Combinator-backed Rever aims to modernize refunds and returns by Kyle Wiggers originally published on TechCrunch

from TechCrunch https://ift.tt/QmbROP4

via IFTTT

Comments

Post a Comment