There are over 1 billion mobile money accounts globally. Africa leads the way in transaction value and volume thanks to M-Pesa, largely used in East Africa. Other regions across the continent are also growing fast.

In 2019, West Africa reported the most live mobile money services in any region, with 56 million active accounts. In Ivory Coast, one of Francophone Africa’s largest mobile money markets, 75% of the population own a mobile money account, compared to 20% who own bank accounts. The difference is staggering and clearly shows the region’s huge appetite for the service.

While telecom operators have largely dominated mobile money services across most of sub-Saharan Africa, a few startups are trying to change the mobile money experience for customers. Ivory Coast-based fintech startup Julaya is one such company, and today, it announced a $2 million pre-Series A funding to expand its products across West Africa.

Julaya was founded in 2018 by Mathias Léopoldie and Charles Talbot. Before launching Julaya, they worked at French payment fintech LemonWay on their service in Mali and Burkina Faso.

Léopoldie told TechCrunch that the experience introduced them to how mobile money worked across Francophone Africa. LemonWay acts as a payment solution for marketplaces. So, while working on expanding the fintech’s service in both countries, the pair noticed the massive potential businesses had to reach the unbanked via the large consumer penetration of telecom operators.

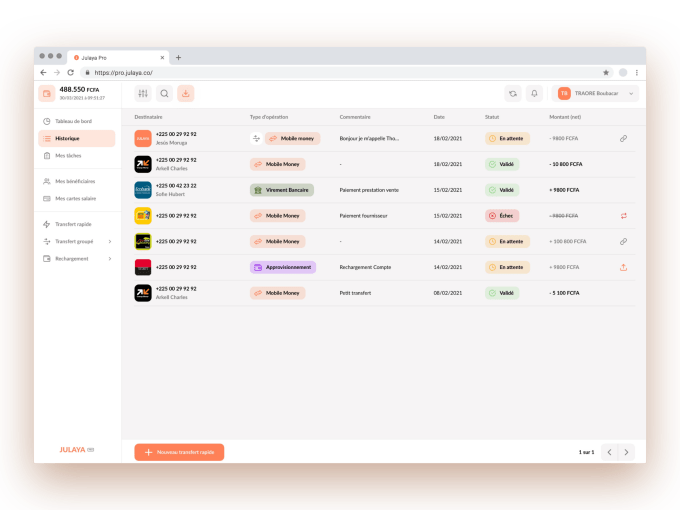

Julaya was launched to digitize trade payments but started in the Ivory Coast instead of Mali and Burkina Faso. The platform enables companies to streamline their accounting and improve their operational efficiency by digitizing payments to workers and suppliers instead of relying on cash.

The company helps African businesses and institutions disburse payments to mobile money and mobile banking wallets. It achieves this by working with telecom operators and other fintech startups in the region.

“Mobile money is coming to a mature stage where business and public institution use-cases provide new growth opportunities for the sector. The pandemic has opened up minds about the urge to digitize payments. Fintech competition in West Africa is making digital finance more affordable for consumers, and technical integrations with telecom operators are becoming more reliable,” Talbot said in a statement.

Yet, these partnerships haven’t come without their own share of challenges. For one, payments technology in Francophone Africa remains quite fragmented, and APIs from telecoms are still burgeoning and somewhat unreliable.

Léopoldie added that challenges come from distribution channels, making it difficult for the company to sell en masse at a cheap cost, as well as from the untrustworthiness of businesses toward digitized payments.

“In Ivory Coast, a wire transfer takes between one to three days, and you always have to check with your bank branch as a customer. … Businesses do not trust digital experiences as they often have shortcomings, and educating the market bears a high cost on acquisition. Then, talents that have a startup mindset are still difficult to find,” Léopoldie said of some of the challenges facing the three-year-old startup.

Despite this, the startup, which has an R&D and technical team in France, has bagged customers from SMBs and large corporates to government institutions. The company says it’s currently processing over $1.5 million monthly for 50 of these customers, including Jumia, SODECI, Ministry of Education, Ivory Coast and the World Bank.

Julaya closed a pre-seed investment of $250,000 in 2018 and a seed investment of $550,000 a year later, all from angel investors. But the company has introduced VC firms in its pre-Series A round. They include corporate venture capital firms Orange Ventures and MFS Africa Frontiers; VC firms Saviu Ventures, Launch Africa and 50 Partners Capital; and some angel investors in Africa and Europe. Julaya will use the investment to broaden its market share in Ivory Coast and launch digital payment products and expand across West Africa.

More than 20 million people use Orange as a mobile money service across 15 African countries. The telecom operator also recently launched a mobile banking platform in Ivory Coast and has surpassed 500,000 users. Thus, what’s the rationale behind this strategic investment, which marks its third check in an African fintech startup after South Africa’s Yoco and Senegal’s SudPay?

“Fintech’s environment in Africa is distinguished by its competitiveness and strong dynamism. Orange Group, through its technology investment fund, intends to participate in this boom by supporting fintechs such as Julaya. The goal is to target local technology champions at the service of the transition to a more digital and responsible world,” said Habib Bamba, the director of Transformation, digital and media at Orange Ivory Coast.

Orange, other telecom operators, fintechs and banks remain big competitors to Julaya. So how does it plan to stay on top of people’s minds across the region? Léopoldie thinks that focusing on the best user experience might do the trick.

“This sounds like an overheard statement, but we understand that what the customer values most is reliable customer support and a predictable and smooth online experience, for instance, a reliable platform with very little downtime,” he said. “Even if you only have a 90% success rate on your transactions, as long as you give this information in a transparent communication to the customer, they will trust you.”

from TechCrunch https://ift.tt/3BNwpRx

via IFTTT

Comments

Post a Comment