Fintech has been a key startup story in recent quarters, with leading players in the genre raising titanic rounds at eye-popping valuations. Consider companies like Robinhood, and its epic capital run this year on the back of huge revenue growth, or Chime, which also raised huge sums while riding a tailwind provided by the savings and investing boom.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

As you can imagine, all those mega-deals have added up. According to data collated by CB Insights on the fintech space in the third quarter, 60% of all capital raised by financial technology startups came from just 25 rounds worth $100 million or more. Adding to the trend of venture getting bigger — and later as unicorns age without graduating to the public markets — the same report noted that fintech investment from $100 million rounds grew 24% compared to Q2, while investment in the space from smaller deals fell 16% over the same timeframe.

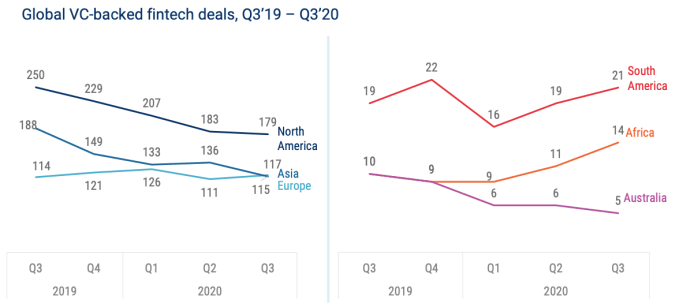

Overall fintech deal volume dipped 24% compared to Q3 2019, totaling 451 global deals. But dollars invested into fintech startups edged up once again to $10.631 billion, the largest result thus far in 2020 and the second-best single-quarter tally since mid-2018.

Overall fintech deal volume dipped 24% compared to Q3 2019, totaling 451 global deals. But dollars invested into fintech startups edged up once again to $10.631 billion, the largest result thus far in 2020 and the second-best single-quarter tally since mid-2018.

Oddly, it was the bottom, as well as the top of the market that did best. As we’ve seen, late-stage money flowed. But, notably, the number of the smaller venture rounds, those marked seed or angel, grew by 20% compared to Q2 2020.

Perhaps the next crop of unicorns is being founded?

Inside the CB Insights data are a few trends worth digging into, including what’s going on with venture investment into payments-focused startups, how the IPO market may be impacting insurtech investment, and how both wealth management startups like Robinhood and banking startups like Chime are faring as cohorts.

The data is fascinating, so let’s get into the state of fintech investing today.

Big trends, bigger dollars

We’re focused on four mega-trends today, but I wanted to start point out that African fintech startups saw what appears to be their all-time record in deal count at 14. That was up from 11 in Q2 2020, and nine in Q1. I’m working to pay more attention to the African tech scene, and those numbers stood out.

As fintech deal count falls in the largest VC markets — North America, Europe, Asia — it is rising in Africa and Latin America, something to keep an eye on.

Via CB Insights, shared with permission.

Now, into our four mega-trends.

Payments

Payments startups like Stripe and Finix get their share of headlines, but they make up only a fraction of the total volume of venture capital investment that their sector absorbs.

Per CB Insights, venture investment into payments startups ticked higher in Q3 2020, rising to $3.959 billion from $2.379 billion in Q2 2020, and $2.927 billion in Q3 2019.

Aside from an anomalous final quarter in 2019, investment into payments-focused startups has been on a steady incline for some time. Why? PayPal earnings offer a partial explanation. As we reported yesterday after the consumer payments giant reported its Q3 performance:

from TechCrunch https://ift.tt/34TeE4L

via IFTTT

No comments:

Post a Comment