With $84 million in new cash, Commonwealth Fusion is on track for a demonstration fusion reactor by 2025

Commonwealth Fusion Systems closed on its latest $84 million in new funding two weeks ago. The U.S. was still very much in the lockdown phase and getting a deal done, especially a multi-million dollar investment in a new technology aiming to make commercial nuclear fusion a reality after decades of hype, was “an interesting thing” in the words of Commonwealth’s chief executive, Bob Mumgaard.

It was actually one time when the technical complexity of what Commonwealth Fusion is trying to achieve and the longterm horizon for the company’s first test technology was a benefit instead of an obstacle, Mumgaard said.

“We’re in a unique position where it’s still something that’s far enough in the future that any of the recovery models are not going to affect the underlying needs that the world still has a giant climate problem,” he said.

Commonwealth Fusion Systems purports to be one solution to that problem. The company is using technology developed at the Massachusetts Institute of Technology to leapfrog the current generation of nuclear fusion reactors currently under development (there are, in fact, several nuclear fusion reactors currently under development) and bring a waste-free energy source to industrial customers within the next ten years.

Commonwealth Fusion Systems core innovation was the development of a high power superconducting magnet that could theoretically be used to create the conditions necessary for a sustained fusion reaction. The reactor uses hydrogen isotopes that are kept under conditions of extreme pressure using these superconducting magnets to sustain the reaction and contain the energy that’s generated from the reaction. Designs for reactors require their hydrogen fuel source to be heated to tens of millions of degrees.

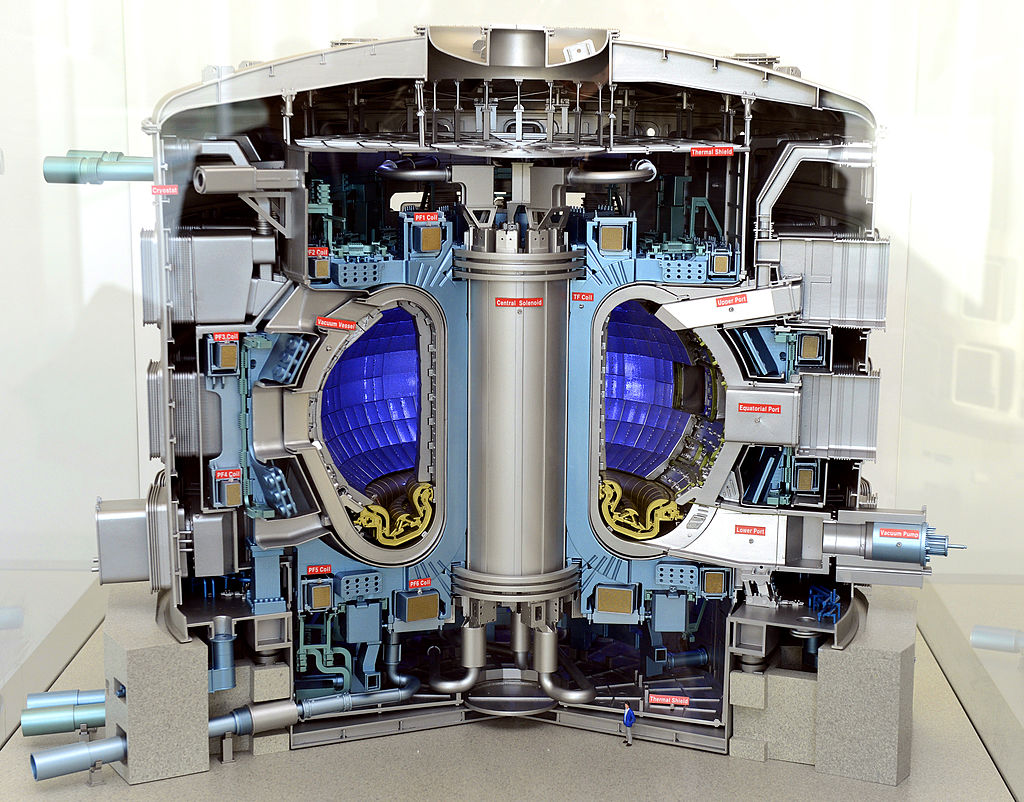

The design that Commonwealth is pursuing is akin to the massive, multi-decade International Thermonuclear Experimental Reactor (ITER) project that’s currently being completed in France. Begun under the Reagan Administration in the eighties, as a collaboration between the U.S., the Soviet Union, various European nations and Japan. Over the years, membership in the project expanded to include India, South Korea, and China.

While the ITER project also expects to flip the switch on its reactor in 2025, the cost has been dramatically higher — totaling well over $14 billion dollars. The project, which began construction in 2013, will also represent a much longer timeframe to completion compared with the schedule that Commonwealth has set for itself.

Picture taken on January 17, 2013 in Saint-Paul-les-Durance, southern France shows the model of the reactor of the future International Thermonuclear Experimental Reactor (ITER) . The International Thermonuclear Experimental Reactor (Iter), based at the French Atomic Energy Commission (CEA) research center of Cadarache in Saint-Paul-lès-Durance, was set up by the EU, which has a 45 percent share, China, India, South Korea, Japan, Russia and the US to research a clean and limitless alternative to dwindling fossil fuel reserves. AFP PHOTO / GERARD JULIEN (Photo credit should read GERARD JULIEN/AFP via Getty Images)

“We have set off to build what has been our big goal all along, which is to build the full scale demonstration magnet… we’re in the act of building that,” said Mumgaard. “We’ll turn that on next year.”

Upon completion, Commonwealth Fusion Systems will have built a ten-ton magnet that has the magnetic force equivalent to twenty MRI machines, said Mumgaard. “After we get the magnet to work, we’ll be building a machine that will generate more power than it takes to run. We see that as the Kitty Hawk moment,” for fusion, he said.

Other startup companies are also racing to bring technologies to market and hit the 2025 timeline. They include the Canadian company General Fusion and the United Kingdom’s Tokamak Energy.

Within the next six to eight months, Commonwealth Energy hopes to have a site selected for its first demonstration reactor.

Financing the company’s most recent developments are a slew of investors new and old who have committed over $200 million to the company, which formally launched in 2018.

The round was led by Temasek with participation from new investors Equinor, a multinational energy company, and Devonshire Investors, the private equity group affiliated with FMR LLC, the parent company of Fidelity Investments.

Current investors including the Bill Gates-backed Breakthrough Energy Ventures; MIT’s affiliated investment fund, The Engine; the Italian energy firm ENI Next LLC; and venture investors like Future Ventures, Khosla Ventures; Moore Strategic Ventures, Safar Partners LLC, Schooner Capital, and Starlight Ventures also participated.

“We are investing in fusion and CFS because we believe in the technology and the company, and we remain committed to providing energy to the world, now and in a low carbon future,” said Sophie Hildebrand, Chief Technology Officer and Senior Vice President for Research and Technology at Equinor, in a statement.

The company said it would use the new financing to continue developing its technology which would offer fusion power plants, fusion engineering services, and HTS magnets to customers. Funding will also be used to support business development initiatives for other applications of the company’s proprietary HTS magnets, the key component to its SPARC reactor, which also has various other commercial uses, the company said.

Helping the cause, and potentially accelerating the timelines for many fusion players is a new initiative from the federal government that could see government dollars go to support construction of new facilities. The Department of Energy recently released a request for information (RFI) on potential cost share programs for the development of nuclear fusion reactors in the U.S.

Modeled after the Commercial Orbital Transportation Services program which brought the world SpaceX, Blue Origin, and other U.S. private space companies, a cost-sharing program for fusion development could accelerate the development of low-cost, pollution free fusion reactors across the U.S.

“The COTS program transitioned the space industry from ‘Here’s a government dictated space sector’ to a vibrant commercial launch industry,” said Mumgaard.

One investor who’s seen the value of public private partnerships to spur commercial innovation is Steve Jurvetson, the founder of Future Ventures, and a backer of Commonwealth Fusion Systems. Jurvetson acknowledged the necessity of fusion investment for the future of the energy industry.

“Fusion energy is an investment in our future that offers an important path toward combating climate change. Our continued investment in CFS fits strongly within our mission as we seek long-term solutions to address the world’s energy challenges,” said Steve Jurvetson, Managing Director and Founder, Future Ventures.

from TechCrunch https://ift.tt/2B5t6KF

via IFTTT

Comments

Post a Comment