Xiaomi, the top smartphone vendor in India, today joined a growing wave of fintech startups in the nation that are offering credit to aspirational young professionals and millennials.

The Chinese electronics giant said today it is launching Mi Credit, its curated marketplace for digital lending, that offers users credit between Rs 5,000 ($70) and Rs 100,000 ($1,400).

Xiaomi said it has partnered with a number of startups such as Bangalore-based ZestMoney, CreditVidya, Money View, Aditya Birla Finance Limited, and EarlySalary to determine who should get a credit and then finance it.

Users are required to let Mi Credit app access their texts and call logs to look for transactional information and some other details to assess whether they are credit worthy. This whole process takes just a few minutes and eligible users can walk out with some credit, said Manu Jain, Vice President of Xiaomi, at a conference in New Delhi.

He added that having multiple partners for the crediting platform ensures that the likeliness of a user securing a loan is high. Once a user has secured a credit from the app, they can avail more credit in the future with a single click, the company said.

For startups that have partnered with Xiaomi, the big draw is access to a large user base, an executive with one of the partner startups told TechCrunch.

Xiaomi, which has been the top smartphone vendor in India for nine consecutive quarters, has an install base in tens of millions in the country. The company has shipped more than 100 million smartphones in the country, it recently revealed.

Xiaomi said the Mi Credit app will be preinstalled on all Xiaomi smartphones running Android-based MIUI operating system. The app is also available for non-Xiaomi Android smartphone users from the Google Play Store. (It’s not available for iPhone users.)

A wave of fintech firms have emerged in recent years in India to help millions of users secure credit and other financial services for the first time in their lives. The penetration of credit card remains very low in the country (roughly three in 100 people in India have a credit card.) This has meant that very few people in the nation have a traditional credit score.

This void has created an immense opportunity for startups to explore a range of other data points to determine who should get a loan. In emerging markets such as India, where the laws are lax, nobody appears to be alarmed with the idea of a company gleaning a lot of personal details.

As of today, Mi Credit is available to users in 1,500 zip codes, or 10 states in India. The company said it plans to extend the credit service to all of India by March next year.

Partner startups involved declined to comment on the financial arrangement they have with Xiaomi. The aforementioned unnamed executive said the agreement would vary with partners and the kind of product they are bringing to the table.

Xiaomi said it has deeply integrated its partners’ offerings into the app. As a result, users are able to see details such as disbursement of loans, lower interest, and credit score in real time.

The company began testing the app with some users in India last month. During the trial, it disbursed loans of over 280 million Indian rupees ($3.9 million).

For Xiaomi, the new offering would help it make its services ecosystem more engaging to consumers. The company, which recently posted one of its slowest growing quarterly reports, has been attempting to cut its reliance on hardware products and make more money off its internet services and through ads.

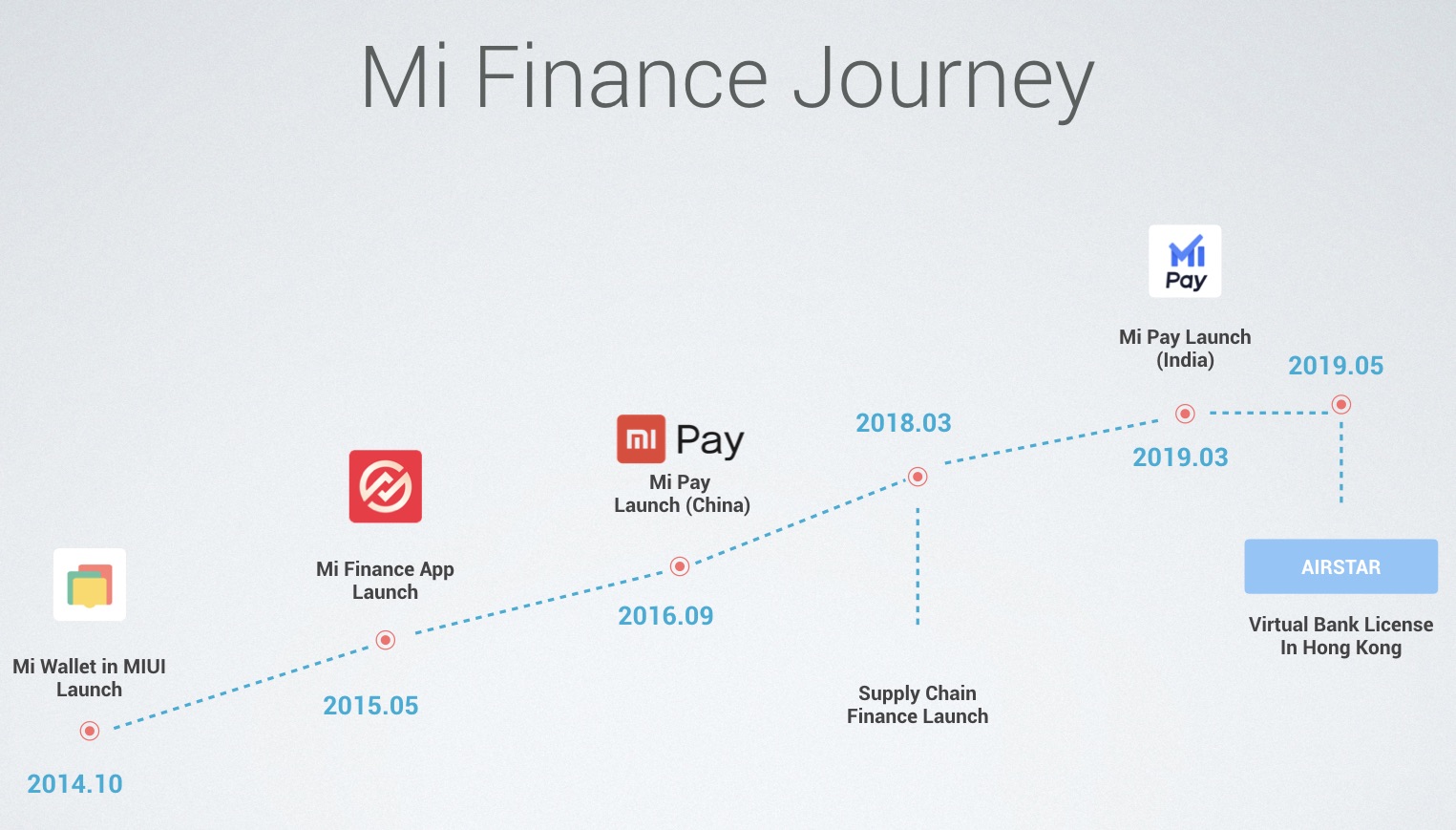

In March this year, Xiaomi launched Mi Pay, a UPI-powered payments app, in India. The company said the app has already amassed over 20 million registered users in the country.

Hong Feng, co-founder and senior vice president of Xiaomi, said the company understands the consumption behaviour of its 300 million users. “It is one of the strengths we aim to leverage to build a stronger Mi Finance business globally. We see a huge opportunity for consumer lending in India with estimations reaching up to $1 trillion dollars in digital lending by 2023, as per a report from BCG. This makes us believe that our Mi Finance business, based on solutions such as Mi Pay and Mi Credit can truly revolutionise the Indian FinTech industry.”

from TechCrunch https://ift.tt/33DmPyo

via IFTTT

No comments:

Post a Comment