Slack’s recent direct listing marks a momentous 15-month stretch for freemium SaaS businesses. With Slack joining the public company ranks, six companies will have tapped the public markets since Dropbox’s IPO last March. This group of companies now has a collective market value of more than $50 billion.

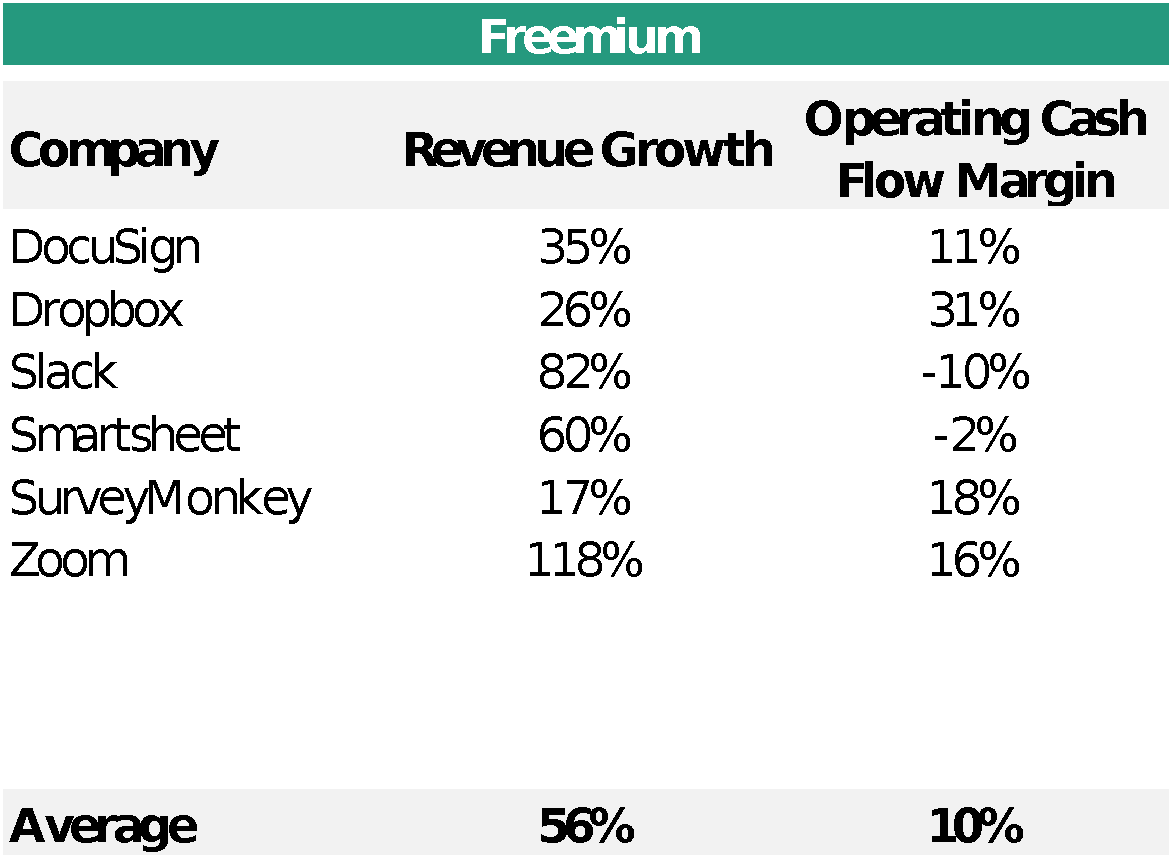

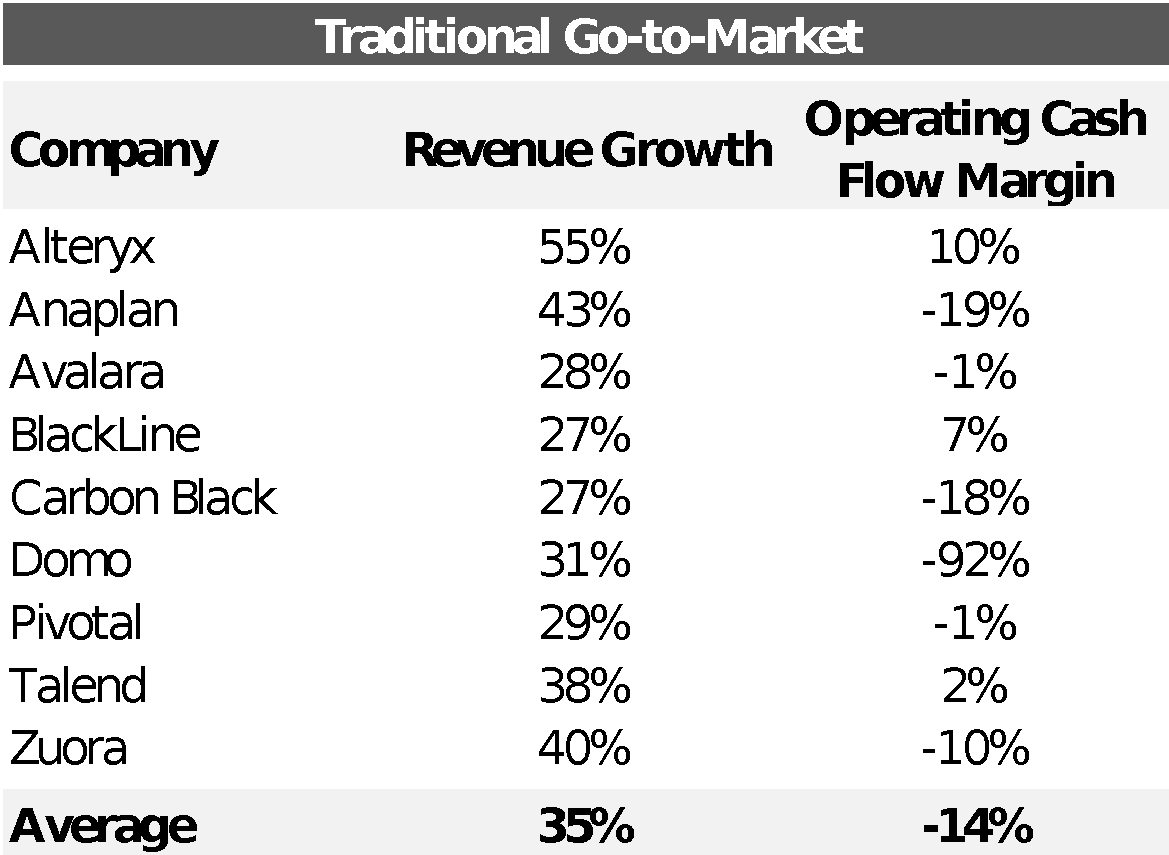

When Zoom filed its public S-1, the tech industry fawned over the company’s financial profile. Here was a company growing revenue over 100% that had somehow managed to be cash flow positive. Conventional wisdom among many Silicon Valley investors has recently been that profits and rapid growth are mutually exclusive.

Uber and other high-growth tech companies aspire to be the next Amazon, foregoing profits into the foreseeable future to establish a dominant market position. This land grab mentality has held sway with most of the SaaS businesses that go to market with a traditional enterprise sales force. In contrast, the recent crop of public freemium businesses show they can actually make money while sustaining attractive growth rates.

Recent IPOs

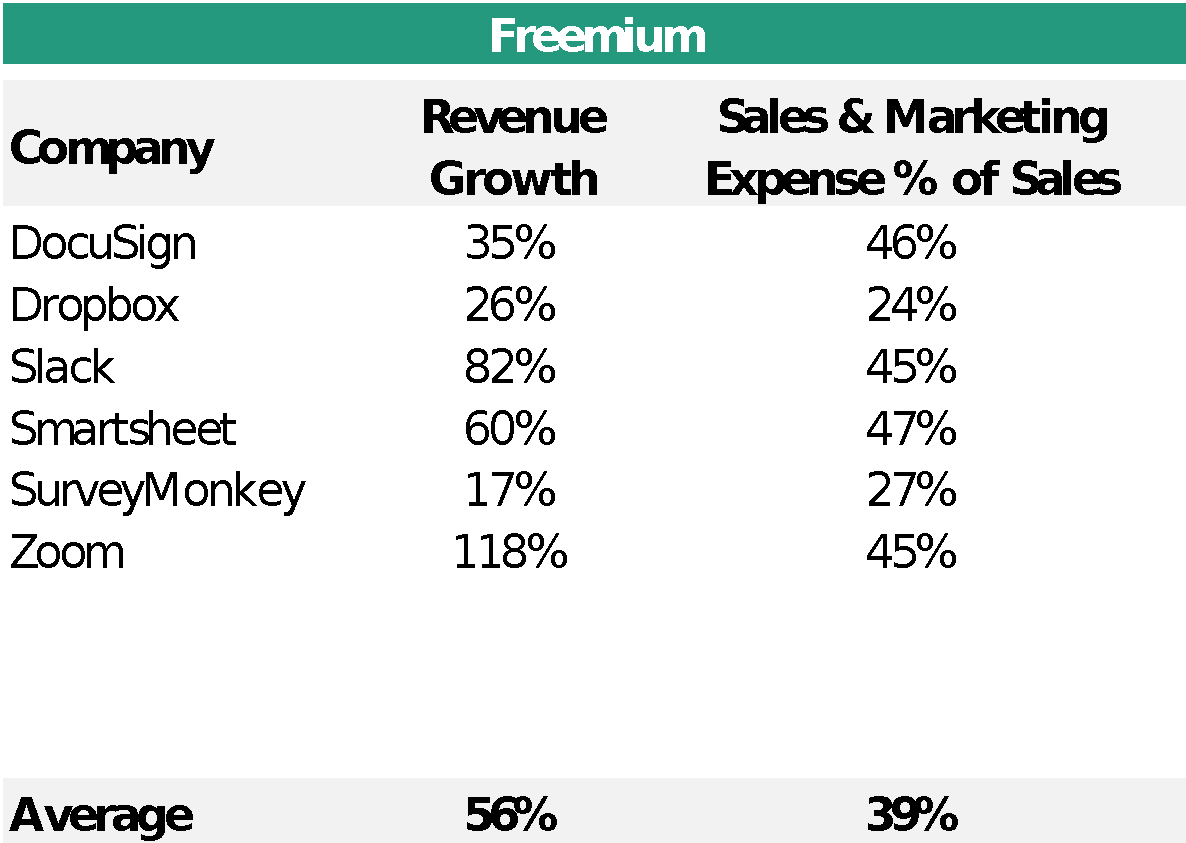

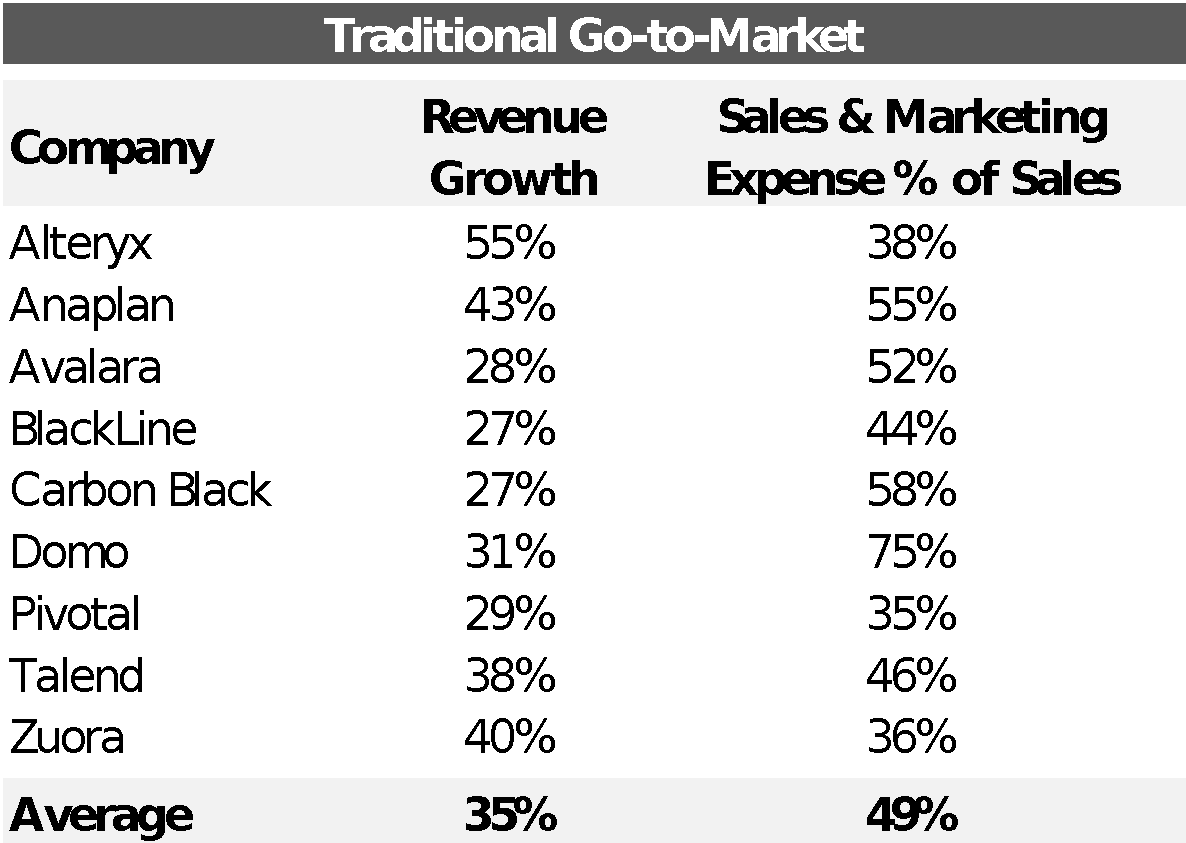

How can this flavor of enterprise software business run so much more efficiently than their traditional enterprise brethren? The answer heavily lies in their approach to sales and marketing. Despite similar growth rates, traditional enterprise SaaS businesses spend an average of 10% more of their revenue on sales and marketing than their freemium comparables.

Freemium vs. enterprise: Different paths to sales success

A common criticism of freemium businesses is that their retention rates dramatically lag those of traditional enterprise software businesses. Customer relationships for freemium businesses usually begin online. An individual employee wants to use a product for her/his own productivity and simply charges a credit card to pay for a subscription. In contrast to larger-ticket enterprise relationships with multiple stakeholders that tend to renew at 90%+ annually, the retention profile of these individual users often resembles consumer subscription businesses — usually in the 60-80% range. When it comes time to renew the subscription a year later, the person may have changed jobs, changed credit cards or only used the product episodically.

It’s less well understood that many of these business models are evolving in real time as they leverage widespread individual adoption to establish broader enterprise customer relationships. When sales reps for freemium products call on enterprise buyers, they usually have hundreds, or even thousands, of their employees already using the product individually or in small teams.

Their products and brands are already widely known and loved, with power-users clamoring for broader internal support and acting as advocates in the sales process. This internal validation makes it much easier to convince an enterprise buyer that the product will deliver compelling value to end users. While some hands-on sales support is usually required to land a contract over $5,000, this job can be done by less-experienced and lower-cost sales reps. If you visit the offices of freemium businesses and ask to walk their sales floor, you’ll see a sea of millennials closing sizeable contracts over the phone.

Legacy enterprise players have historically successfully fended off competition from freemium businesses by accusing them of not being “enterprise-grade” technology. It can take years to build out robust security infrastructure, deep integration into other systems and administration and reporting capabilities, all of which are needed in the enterprise procurement process. This was a muscle that freemium businesses, whose product orientation was around end-user design rather than back-end infrastructure capabilities, needed to build. They also had to build sales motions to navigate the longer, complex sales cycles that come with six and seven-figure annual recurring revenue (ARR) deals.

However, the financial results of these public freemium companies show just how well this is now working, and there are many more private companies following their lead.

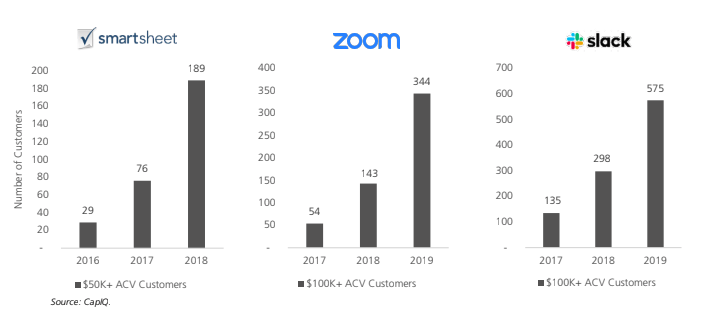

Freemium’s enterprise traction

Most public companies don’t report granular renewal rates for their larger enterprise relationships, but the unit economics of these businesses are incredibly compelling.

Lucid Software now has more than 3,000 enterprise customers, which generates more than 60% of the company’s revenue, up from just 350 and 15% when we invested in the company three years ago. The logo renewal rate for their 3,000+ enterprise customers is more than 95% and net revenue retention is more than 130% annually, because end user seat growth more than outstrips any customer losses.

At Spectrum Equity, we’re watching with interest as these early freemium leaders emerge as successful public companies and the broader industry better understands how these business models work. Since leading SurveyMonkey’s first financing more than 10 years ago, Spectrum has invested in Lucid Software, Bitly, Litmus and Prezi, which are all charting a similar course from freemium online through to the enterprise. A number of Spectrum’s content businesses, such as Lynda.com, Teachers Pay Teachers, Headspace, DataCamp, Offensive Security and Digital Marketing Institute, have also successfully built hybrid individual and enterprise distribution strategies.

We believe companies that create the most compelling end-user experiences will win over the long term, and this trend of the consumerization of enterprise technology has only just begun.

(Note from Spectrum Equity: The specific companies identified above may not represent all of Spectrum’s investments, and no assumptions should be made that any investments identified were or will be profitable. View the complete list of our portfolio companies.)

from TechCrunch https://ift.tt/2ITgN5p

via IFTTT

No comments:

Post a Comment