Asia’s venture capital-backed startups are gunning for Starbucks.

In China, the U.S. coffee giant is being pushed by Luckin Coffee, a $2.2 billion challenger surfing China’s on-demand wave, and on the real estate side, where WeWork China has just unveiled an on-demand product that could tempt people who go to Starbucks to kill time or work.

That trend is picking up in Indonesia, the world’s fourth largest country and Southeast Asia’s largest economy, where an on-demand challenger named Fore Coffee has fuelled up for a fight after it raised $8.5 million.

Fore was started in August 2018 when associates at East Ventures, a prolific early-stage investor in Indonesia, decided to test how robust the country’s new digital infrastructure can be. That means it taps into unicorn companies like Grab, Go-Jek and Traveloka and their army of scooter-based delivery people to get a hot brew out to customers. Incidentally, the name ‘Fore’ comes from ‘forest’ — “we aim to grow fast, strong, tall and bring life to our surrounding” — rather than in front of… or a shout heard on the golf course.

The company has adopted a similar hybrid approach to Luckin, and Starbucks thanks to its alliance with Alibaba. Fore operates 15 outlets in Jakarta, which range from ‘grab and go’ kiosks for workers in a hurry, to shops with space to sit and delivery-only locations, Fore co-founder Elisa Suteja told TechCrunch. On the digital side, it offers its own app (delivery is handled via Go-Jek’s Go-Send service) and is available via Go-Jek and Grab’s apps.

So far, Fore has jumped to 100,000 deliveries per month and its app is top of the F&B category for iOS and Android in Indonesia — ahead of Starbucks, McDonald’s and Pizza Hut.

It’s early times for the venture — which is not a touch on Starbuck’s $85 billion business; it does break out figures for Indonesia — but it is a sign of where consumption is moving to Indonesia, which has become a coveted beachhead for global companies, and especially Chinese, moving into Southeast Asia. Chinese trio Tencent, Alibaba and JD.com and Singapore’s Grab are among the outsiders who have each spent hundreds of millions to build or invest in services that tap growing internet access among Indonesia’s population of over 260 million.

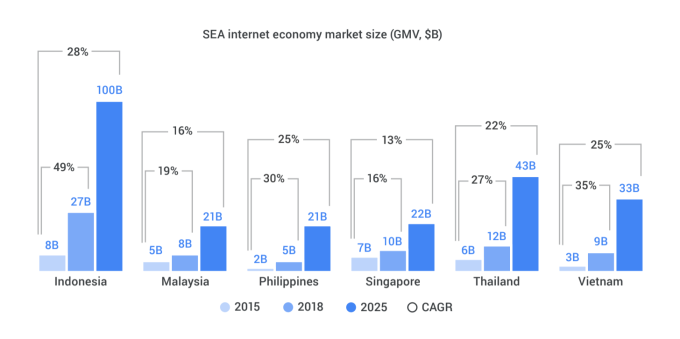

There’s a lot at stake. A recent Google-Temasek report forecast that Indonesia alone will account for over 40 percent of Southeast Asia’s digital economy by 2025, which is predicted to triple to reach $240 billion.

As one founder recently told TechCrunch anonymously: “There is no such thing as winning Southeast Asia but losing Indonesia. The number one priority for any Southeast Asian business must be to win Indonesia.”

Forecasts from a recent Google-Temasek report suggest that Indonesia is the key market in Southeast Asia

This new money comes from East Ventures — which incubated the project — SMDV, Pavilion Capital, Agaeti Venture Capital and Insignia Ventures Partners with participation from undisclosed angel backers. The plan is to continue to invest in growing the business.

“Fore is our model for ‘super-SME’ — SME done right in leveraging technology and digital ecosystem,” Willson Cuaca, a managing partner at East Ventures, said in a statement.

There’s clearly a long way to go before Fore reaches the size of Luckin, which has said it lost 850 million yuan, or $124 million, inside the first nine months in 2018.

The Chinese coffee challenger recently declared that money is no object for its strategy to dethrone Starbucks. The U.S. firm is currently the largest player in China’s coffee market, with 3,300 stores as of last May and a goal of topping 6,000 outlets by 2022, but Luckin said it will more than double its locations to more than 4,500 by the end of this year.

By comparison, Indonesia’s coffee battle is only just getting started.

from TechCrunch https://tcrn.ch/2Gff9dA

via IFTTT

No comments:

Post a Comment