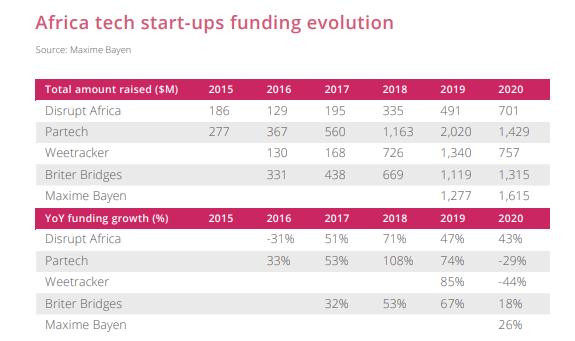

Investments in African startups keep growing at a healthy pace ever since reports started keeping count in 2015. That year, publications Disrupt Africa and Partech released independently researched and contrasting figures showing that venture capital investments hit $186 million and $277 million, respectively. Those are ridiculously low figures for a continent when you consider that four-year-old Snapchat raised more than $500 million in one round that same year. However, while the disparity in funding between Africa and a single high-growth U.S. startup continues, the good news is that more money is coming into the continent.

In 2019, Africa’s venture capital investments rose to an all-time high, per Partech’s report. According to Partech, 234 African tech companies raised $2.02 billion in 250 equity rounds. This indicated a 74% increase from 2018’s figure of $1.163 billion raised by 146 startups in 164 rounds.

There was shared optimism that 2020 would record a new high, but that was before the pandemic struck. For that reason, African tech ecosystem accelerator AfricArena predicted that venture capital funding in the continent’s startups would fall between $1.2 billion and $1.8 billion. In what may be described as an educated guess or a calculated prediction by the publication, year-end reports by Partech and Briter Bridges pegged total investment raised at $1.4 billion and $1.3 billion, respectively.

This year, AfricArena, in a new report, is predicting that VC funding in the continent’s startups would increase between $2.25 billion and $2.8 billion, which, if met, will surpass 2019 figures for a record high on the continent.

Here’s the rationale behind the prediction from an excerpt in the report:

We foresee that the first two quarters of 2021 will be similar Q4 2020 with the mix of factors. Vaccine campaigns will likely take longer than hoped to have a meaningful impact. However, this rollout – regardless of how long they will actually take – will eliminate the major uncertainty about the end of the pandemic, which is only a question of time.

As a result, we expect an extremely strong acceleration of deals from seed to Series B as well as major growth deals, together with some IPOs (Nigeria’s Interswitch, for example), that will propel deal activity to never seen before levels of activity. As of April 2020, our forecast for 2021 ranged from under $1.6 billion to over $3 billion. The worst-case scenario was based on a prolonged and fragmented impact on the African economies and the best-case scenario factoring in a full recovery Q1 2021. Based on the above observations, our views are now that 2021 will range between $2.25 and $2.8 billion.

As of April 30, the total disclosed venture capital funding stood a little over $800 million, according to Maxime Bayen, deal tracker and senior venture builder at BFA Global. If that pace is kept throughout the year, African startups might raise more than $2 billion.

Image Credits: AfricArena

In 2020, the number of early-stage deals increased, but there was a drop in growth deals and overall ticket sizes, constituting the drop in funding activities. Per Partech, seed rounds grew 80% year-on-year and accounted for 64% of all deals made. In total, African startups raised $220 million in seed funding, which was a 47% increase year on year. Series A and B rounds grew likewise. Series A deals went up 9% (86 rounds), and Series B deals, 16% (29 rounds), yet their investment sizes dropped 5% ($447 million) and 8% ($449 million), respectively.

Growth deals also dropped by 16%, and only two deals closed above $50 million compared to the 10 that took place in 2019, some of which include Interswitch, OPay, Branch and Andela.

The driving force to exceed the $2 billion mark in 2021 lies on VCs to make more deals and startups to replicate the large growth rounds of 2019. The former appears to be in place as African startups continue to raise money week in and week out. However, there’s still work to be done for the latter, as only two African startups have raised more than $100 million in a single round so far — fintech startups Flutterwave and TymeBank.

from TechCrunch https://ift.tt/3fknf60

via IFTTT

No comments:

Post a Comment