Jai Kisan, an Indian startup that is attempting to bring financial services to rural India, where commercial banks have a single-digit penetration, said on Monday it has raised $30 million in a new financing round as it looks to scale its business.

Hundreds of millions of people in India today live in rural areas. Most of them don’t have a credit score. The professions they work on — largely farming — aren’t considered a business by most lenders in India. These farmers and other professionals also don’t have a documented credit history, which puts them in a risky category for banks to grant them a loan.

Much of the credit these people do raise ends up getting invested in unproductive usage, which leads to higher interest and default rates.

Three-year-old Mumbai-headquartered Jai Kisan is attempting to address this by treating farmers and other similar professionals as businesses instead of consumers.

The startup has developed its own system — which it calls Bharat Khata — that is helping individuals and businesses get access to cheaper financing and ensures that the money they raise is being used for agri-inputs and equipment and other income generating purposes and enablement of rural commerce transactions.

Arjun Ahluwalia, co-founder and chief executive of Jai Kisan, said financial services is crucial for these individuals as their entire economy depends on it. “The ability to buy now and pay later is how most people shop for things in India. Credit is an expectation by the Indian customer — it’s not a value added service,” he told TechCrunch in an interview.

“If there is availability of formal financing to customers, it’s not just customer who does well. The entire ecosystem that revolves around that customer benefits,” he said, pointing to the rise of Bajaj Finance, which has helped several businesses flourish in India by giving credit to customers at the time of purchase, and Xiaomi, India’s largest smartphone vendor, which sells a large number of its devices to customers on monthly instalment plans.

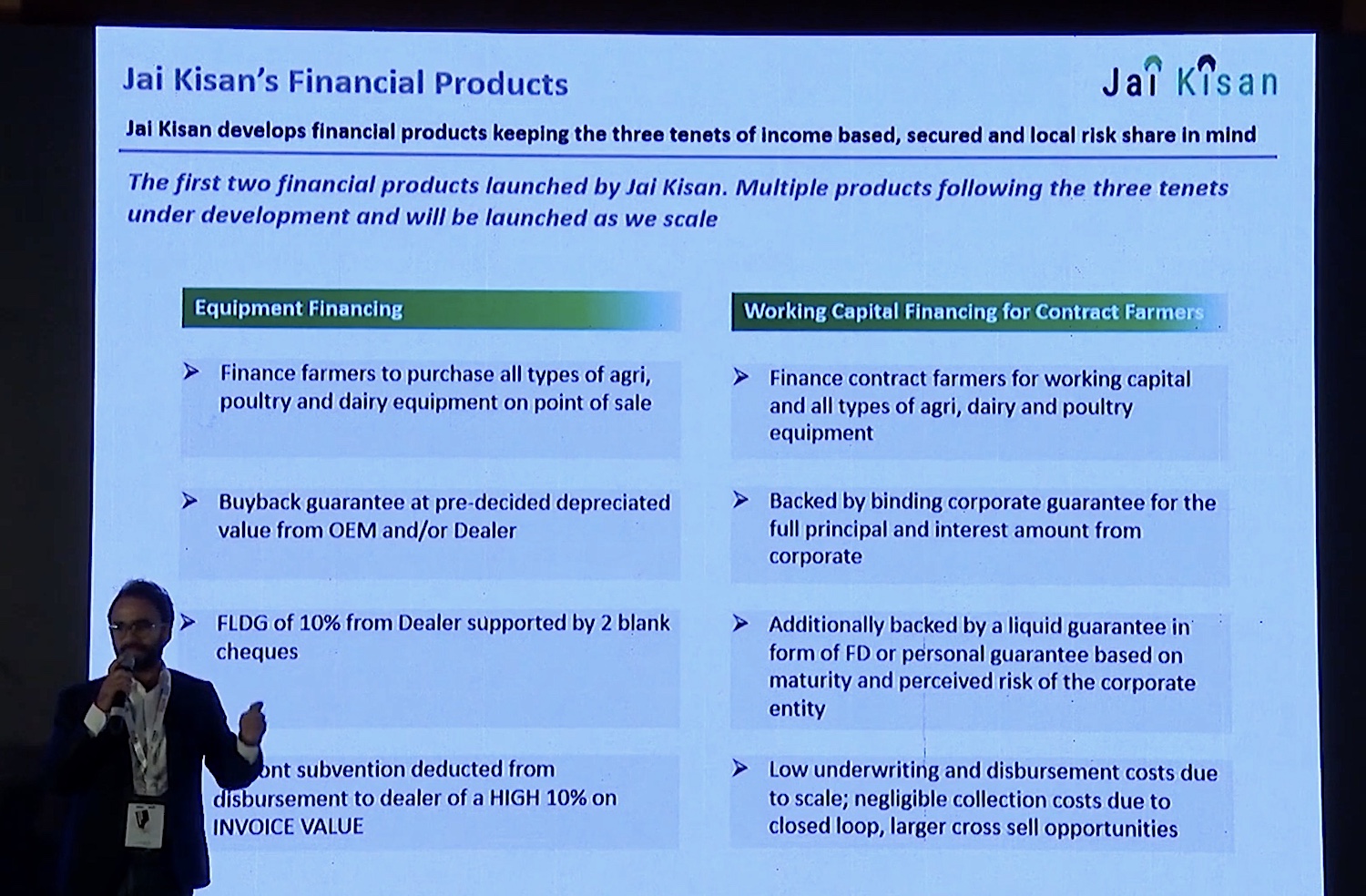

Ahluwalia at a conference in 2019 (India FinTech Forum)

Bharat Khata service, which was launched in April last year, captured more than $380 million of annualized GTV run-rate across over 25,000 storefronts by the financial year that ended in March this year, the startup said.

“Jai Kisan has financed over 15% of the transactions which portrays the monetizability and quality of commerce being captured. The ability to have visibility and virality of high-quality transactions has enabled Jai Kisan to scale business by over 50% in 3 months. The unprecedented growth trajectory stands testament to Jai Kisan’s capabilities to deploy capital efficiently by focusing on core customer credit needs,” the startup said.

The startup, which operates in eight Indian states in South India, is now looking to scale its presence across the country and also increase the headcount. On Monday, it said it had raised $30 million in a Series A round led by Mirae Asset, Syngenta Ventures, and existing investors Blume, Arkam Ventures, NABVENTURES, Prophetic Ventures and Better Capital.

An unspecified amount of the financing was raised as debt from Blacksoil, Stride Ventures, and Trifecta Capital.

“Jai Kisan is at the cusp of disrupting the rural financing industry and we’re glad to be a part of their growth story. Jai Kisan’s stellar growth, excellent asset quality and expanding footprint make them a highly differentiated player in the segment,” said Ashish Dave, chief executive of the India Venture Investments for the South Korean firm Mirae Asset.

“Mirae Asset has always believed in backing companies which aim to become category leaders which is evident from our other investments and we believe Jai Kisan is on the journey of doing so for rural finance,” he added.

Like most fintech startups, Jai Kisan has so far relied on its banking and other financial institutions to finance credit to businesses. The startup said it will now finance 20% of all loans by itself. Which is why it is also raising some money in debt in the new round.

from TechCrunch https://ift.tt/2TulN8x

via IFTTT

Comments

Post a Comment