Gorgias raises $14M to help e-commerce companies deliver faster (and more lucrative) customer service

Gorgias, a startup offering artificial intelligence tools for customer service and support, is announcing that it has raised $14 million in Series A funding.

Co-founder and CEO Romain Lapeyre told me that the startup (whose name is pronounced “gorgeous”) is taking advantage of a broader shift as brands are looking to sell directly to consumers, rather than going through intermediaries like Amazon — for example, he pointed to Nike’s recent decision to pull its products from Amazon.

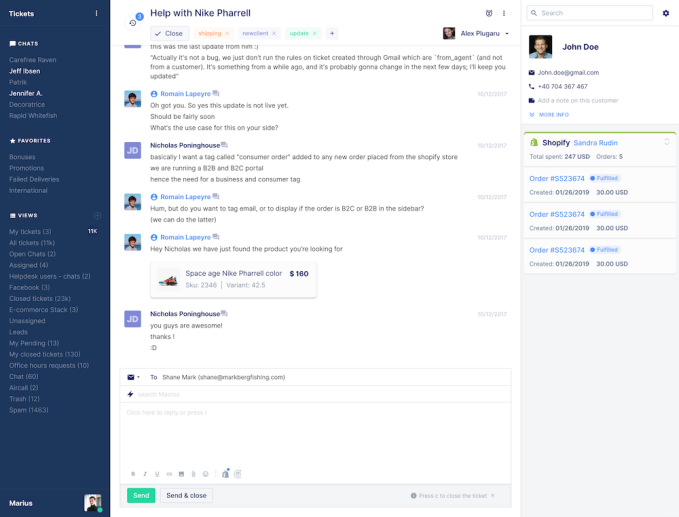

As brands make this change, Lapeyre (pictured above with his co-founder and CTO Alex Plugaro) said they need a “bundle of tools” to build their online business, and “each little part of the bundle is separate.” So they might create a store with Shopify, accept payments via Stripe — and naturally, Lapeyre believes they should be handling their customer support through Gorgias.

The product integrates with Shopify, using AI and customer data to automate responses to basic questions like, “What’s my tracking number?” By doing this, the business can free customer service representatives from spending most of their time responding to these routine requests, and the customers get faster answers.

“The automation should just be the very basic questions,” Lapeyre added.

But even when it comes to more complex queries, Gorgias also provides tools that help the customer service representatives to respond more quickly and to upsell customers on additional products and services — Lapeyre said they’re acting as “sales associates rather than customer service agents.”

It seems like this approach is becoming a reality at some of Gorgias’ 2,000 customers — the Groovelife customer service team gets paid a commission based on upselling. At Steve Madden, meanwhile, the customer service team is using automation to respond to 20% of tickets.

Gorgias previously raised $1.5 million in seed funding. The new round was led by Flex Capital, with participation of SaaStr, Alven, CRV, Amplify Partners and Eric Yuan.

Lapeyre said Gorgias will use the money to build out the product with new features while also bringing on more merchants.

from TechCrunch https://ift.tt/37Eq382

via IFTTT

Comments

Post a Comment