It’s more than a feeling. According to new data coming out from the research firm Pitchbook and the National Venture Capital Association, venture firms are raising — and deploying — a lot less money than in recent years.

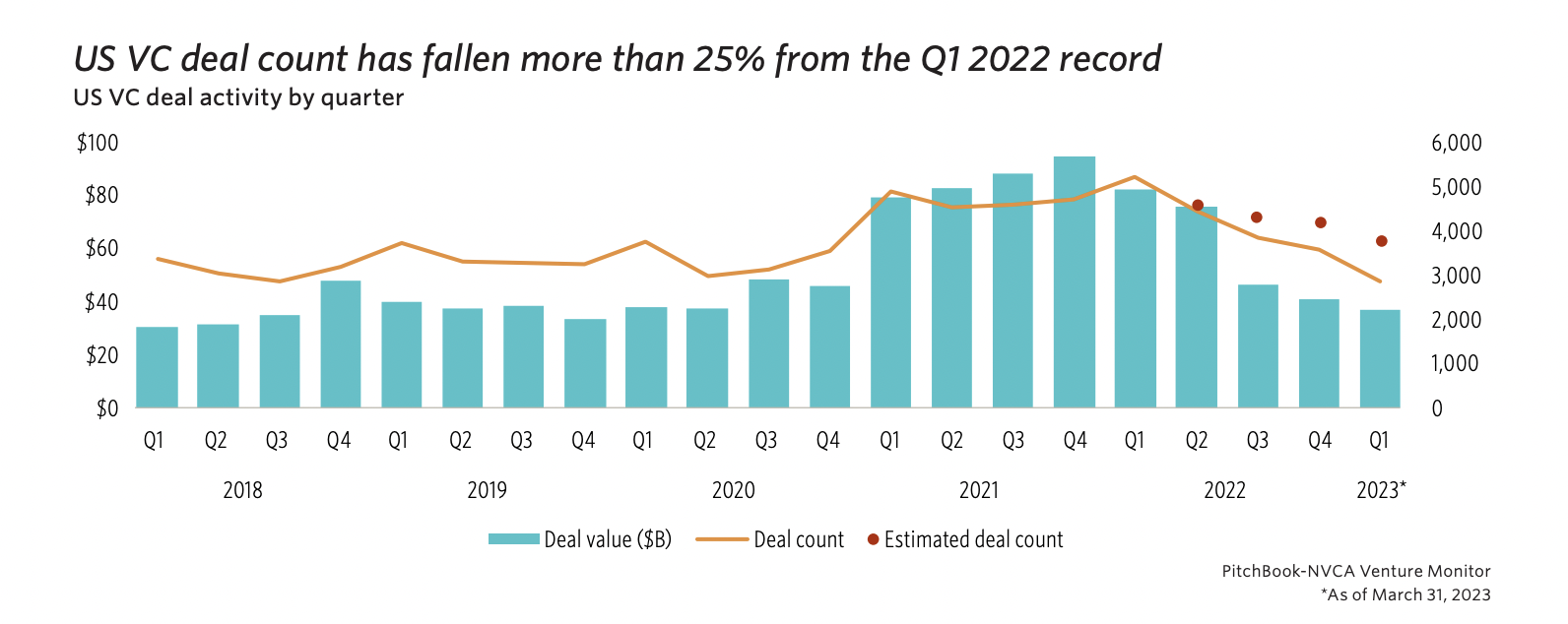

What to know: overall deal count in the U.S. has fallen more than 25% between the first quarter of last year and this year. Less than 3,000 deals were closed between the start of the year and the end of March, which doesn’t sound so terrible until you realize things haven’t been so slow, comparatively, since 2018 (see chart below).

Late-stage deal value also dropped like a boulder in the first quarter. While it’s obvious from recent headlines that the era of the “mega round” has come and gone (for now), it’s something else to read that late-stage values have declined for the seventh straight quarter to $11.6 billion, according to Pitchbook and the NVCA. The two say that just 19 late-stage mega rounds occurred in the first quarter of 2023, compared with a stunning 98 in Q1 2022.

Unsurprisingly, that slowdown, or right-sizing, or whatever you prefer to call it, has had ripple effects. In the first quarter, per the organizations’ findings, the median late-stage, pre-money valuation fell 16.9% from the 2022 full-year figure to $54 million, while the average pre-money valuation declined by more than $100 million to $159 million.

The industry is getting squeezed on all sides. According to the latest data, $11.7 billion was closed across 99 venture capital funds in the first quarter of this year — most of that money raised by larger-size vehicles and the lion’s share, seemingly, by NEA alone, which said in January that it closed on $6.2 billion in capital commitments across two new funds. Indeed, while just two venture funds closed on $1 billion or more in the first three months of this year, last year, 36 funds were closed with more than $1 billion in commitments.

At the same time that they’re garnering less in the way of capital commitments, VCs’ portfolio companies are getting stuck in a kind of exit purgatory, too. According to the NVCA and Pitchbook, just $5.8 billion in exit value was closed in the first quarter, which is apparently less than 1% of the total exit value generated in 2021 (it was a record year, but ouch). With the IPO window shut tight — there were only 20 public listings in the first quarter — “pressure continues to build within the ecosystem,” observes the authors of this latest “venture monitor” report.

To learn more, stay tuned; next week, the organizations are planning to drop a lot more data. In the meantime, if you want to take a look at some of these numbers yourself, you can find them here.

That slowdown you’re feeling, by the numbers by Connie Loizos originally published on TechCrunch

source https://techcrunch.com/2023/04/05/that-slowdown-youre-feeling-by-the-numbers/

No comments:

Post a Comment