A startup that is helping over 125,000 neighborhood stores in India secure working capital, inventory from top brands, and work with e-commerce firms to boost revenues said on Thursday it has raised a new financing round as it looks to further its reach in the world’s second largest internet market.

Pune-based ElasticRun said it has raised $75 million in its Series D financing round co-led by existing investors Avataar Ventures and Prosus Ventures. Existing investor Kalaari Capital also participated in the round, which takes the four-year-old startup’s to-date raise to $130.5 million.

Millions of neighborhood stores that dot large and small cities, towns and villages in India and have proven tough to beat for e-commerce giants and super-chain retailers are at the center of a new play in the country.

A score of e-commerce companies, offline retail chains and fintech startups are now racing to work with these mom and pop stores as they look to tap a massive untapped opportunity.

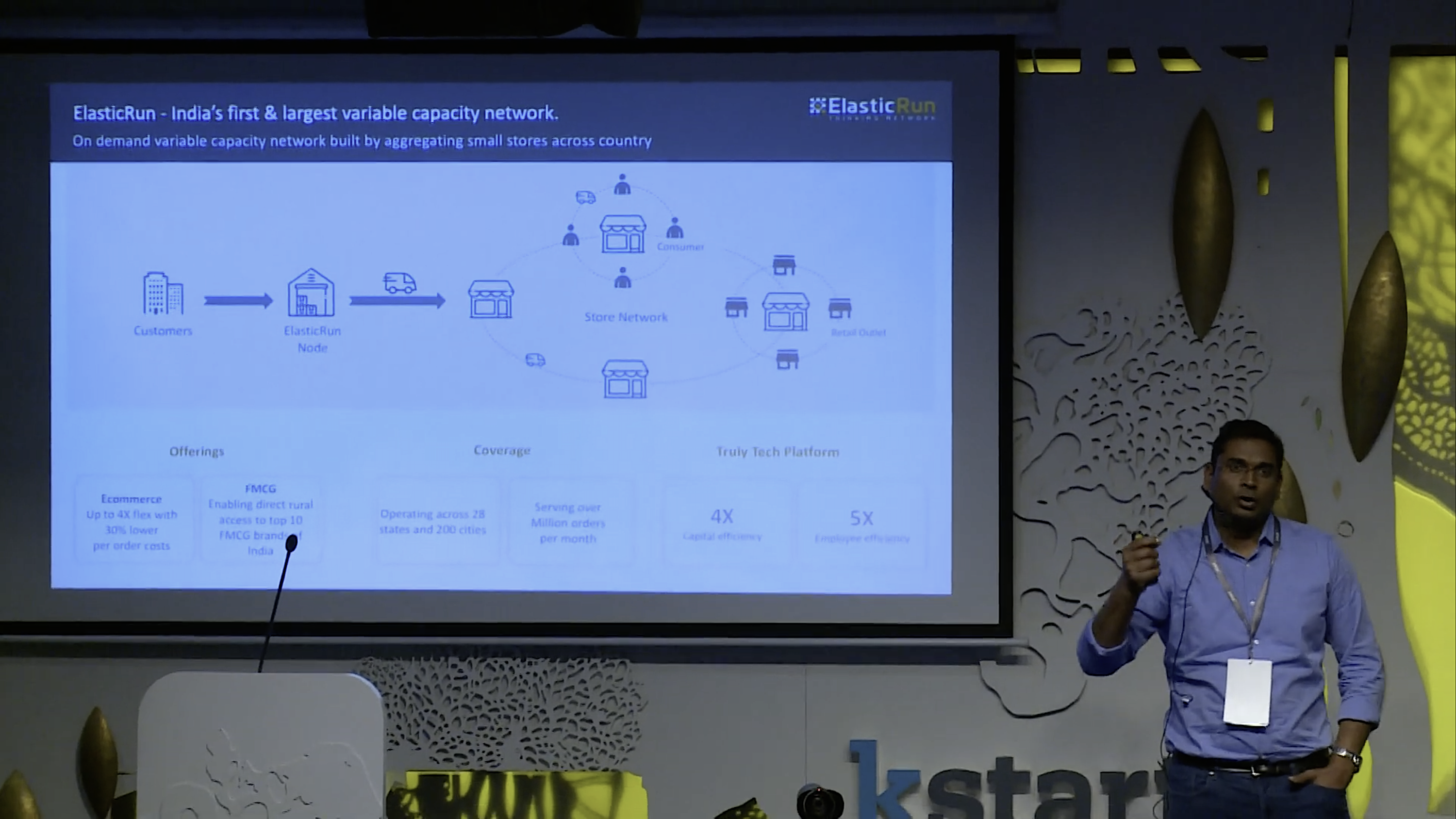

Sandeep Deshmukh, co-founder and CEO of ElasticRun, talking about the startup’s business at a conference in 2019.

ElasticRun helps merchants operating these stores, who typically have to spend a few days a month visiting bigger cities to secure inventory, get reliable and more affordable goods directly from big brands. (Big brands love this because this enables them to significantly expand their reach.)

These store owners also spend a number of hours a day not doing much when the business is slow. ElasticRun is also addressing this by partnering with some of the biggest e-commerce firms including Amazon and Flipkart to utilize this workforce to make deliveries to customers. (E-commerce firms find value in this because neighborhood stores have a larger presence in the country, can reach a customer much faster, and also often have their own inventory.)

Ashutosh Sharma, Head of Investments for India at Prosus Ventures, told TechCrunch that ElasticRun has built a variable capacity, crowdsourced delivery model, which distinguishes the startup from other players in the market that have a fixed number of people on payrolls making these deliveries. He said as the startup has developed the railroads, a number of new opportunities has unlocked.

One such opportunity is providing working capital to these neighborhood stores. Their operators typically don’t have savings, and need to sell the existing inventory to secure funds to refill the stock. In recent years, ElasticRun has struck partnerships with banks and NBFCs to provide credit to these merchants.

ElasticRun today operates in over 300 cities in nearly all Indian states. The startup works with over 125,000 neighborhood stores, and plans to expand to reach 1 million in 18 to 24 months, said Shitiz Bansal, co-founder and chief technology officer of ElasticRun, in an interview with TechCrunch.

The startup’s current run rate is about $350 million, a figure it plans to grow to over $1 billion in the next 12 months, he said.

Saurabh Nigam, co-founder and chief operating officer, said the new financing round has also enabled the startup to offer early employees access to “tangible benefits” of the firm’s growth over the last five years.

from TechCrunch https://ift.tt/2QHGz3t

via IFTTT

Comments

Post a Comment