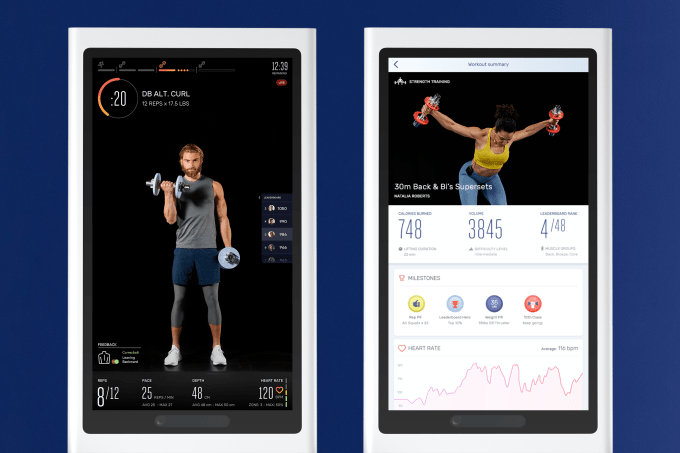

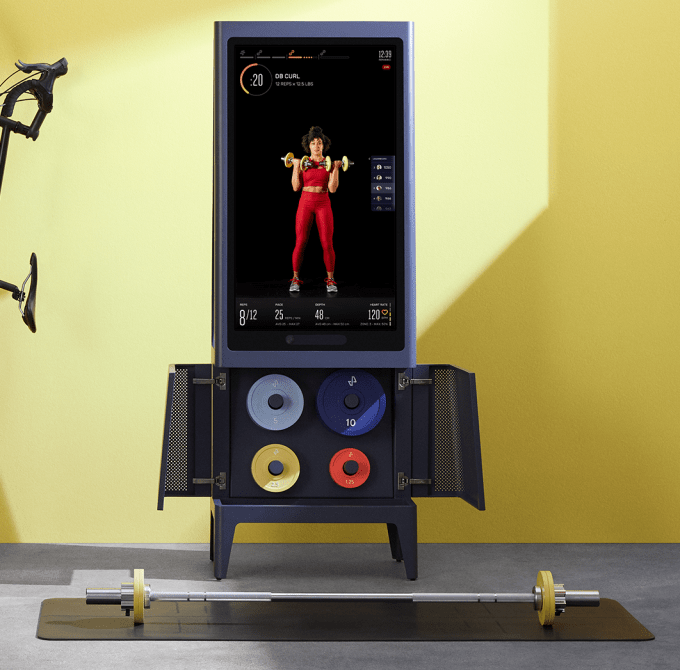

Tempo wants to be the Peloton of barbells. It’s a 42-inch tall screen with 3D machine vision that tracks and teaches you as you workout. The giant upright HD display makes it feel like your personal trainer is right there with you while you compete with others in live and on-demand classes.

Tempo’s motion sensors scan you 30 times per second and notify you if your form is wrong. It’s all housed in a sleekly designed free-standing cabinet that neatly houses all the included barbell, dumbbells, attachable weights, workout mat, recovery foam roller, and workout mat.

Tempo opens for pre-orders today for $1995, requiring a $250 deposit and $39 monthly content subscription before shipping this summer.

“Every single product in the market took a piece of equipment out of a gym and slapped a screen on it” says Tempo CEO and co-founder Moawia Eldeeb. “You need to be able to see a user to actually be able to give them guidance so they can work out safely. We wanted to build a fitness experience from the ground up with training and form feedback at the core of it.”

I demo’d Tempo this week and found the in-home convenience, motivational on-screen personal trainers, and the real-time posture corrections gave me the confidence to lift weights without the fear of injury. It might not feel quite as fun and addictive as Peloton, but makes a facsimile of personal training more affordable than in-person classes that cost $100 or more.

The idea of democratizing access to trainers is what convinced Eldeeb and the Tempo team to stretch its initial $1.7 million in seed funding for four years. While collecting data from its SmartSpot in-gym weight lifting assessment device, Tempo survived long enough to build this prototype. “Most investors had given up on us. We built this product and had just $700,000 left” Eldeeb recalls. But once people could try Tempo, “we pitched 10 investors and got 9 term sheets. It got very competitive.” The startup walked away with a $17.5 million round from Founders Fund, DCM, and Khosla Ventures.

For those comfortable lifting the cheap weights they have at home or hitting up a budget gym, Tempo might seem needlessly overwraught and expensive. But for anyone who needs more instruction or wants to get a Barry’s Bootcamp-worthy workout at home, Tempo might be just their speed.

from TechCrunch https://ift.tt/2T3F3qS

via IFTTT

Comments

Post a Comment