Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

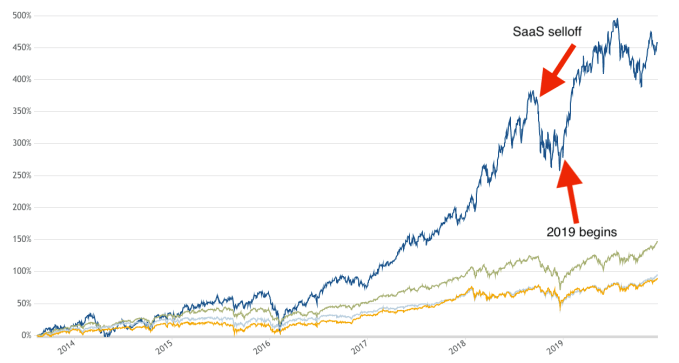

Today, something short. Continuing our loose collection of look backs of the past year, it’s worth remembering two related facts. First, that this time last year SaaS stocks were getting beat up. And, second, that in the ensuing year they’ve risen mightily.

If you are in a hurry, the gist of our point is that the recovery in value of SaaS stocks probably made a number of 2019 IPOs possible. And, given that SaaS shares have recovered well as a group, that the 2020 IPO season should be active as all heck, provided that things don’t change.

Let’s not forget how slack the public markets were a year ago for a startup category vital to venture capital returns.

Last year

We’re depending on Bessemer’s cloud index today, renamed the “BVP Nasdaq Emerging Cloud Index” when it was rebuilt in October. The Cloud Index is a collection of SaaS and cloud companies that are trackable as a unit, helping provide good data on the value of modern software and tooling concerns.

If the index rises, it’s generally good news for startups as it implies that investors are bidding up the value of SaaS companies as they grow; if the index falls, it implies that revenue multiples are contracting amongst the public comps of SaaS startups.1

Ultimately, startups want public companies that look like them (comps) to have sky-high revenue multiples (price/sales multiples, basically). That helps startups argue for a better valuation during their next round; or it helps them defend their current valuation as they grow.

Given that it’s Christmas Eve, I’m going to present you with a somewhat ugly chart. Today I can do no better. Please excuse the annotation fidelity as well:

from TechCrunch https://ift.tt/379gWv8

via IFTTT

Comments

Post a Comment