The social media apocalypse is on us this week. Days after Facebook’s stock took a record $12 billion plunge on a poor earnings report, Twitter’s shares are down nearly 20 percent after the company announced falling users numbers.

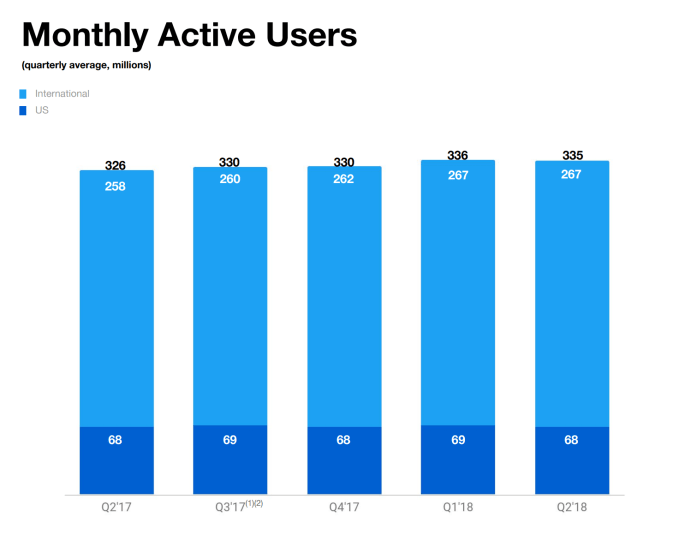

The microblogging service recorded a drop of one million monthly users in Q2, with 335 million overall and 68 million in the U.S.. International users stayed consistent, with U.S. numbers down from 69 million in the previous quarter.

Bloomberg reported that Twitter’s share price sunk by 17 percent in early trading following the earnings announcement.

The market seems spooked that Twitter has failed to grow in the U.S.. Indeed, one year ago it recorded 68 million users on home turf, and while it has grown its international presence by a fairly modest 3.5 percent over that period, there are doubts as to whether Twitter can increase its audience.

Twitter has increased its efforts finding and suspending fake accounts, which is said to have doubled over the past year, but it also said that it didn’t expect that to impact users numbers this quarter, so that explanation is off the table.

While Twitter can (just about argue) that its daily user number grew by 11 percent in the quarter — a little higher than 10 percent in Q1 — the company doesn’t actually disclose this number.

The stock will be frustrating for executives because, in its favor, Twitter had a record quarter of profit. GAAP net income came in at $100 million with revenue climbing 24 percent year-on-year to reach $711 million. Adjusted EBITDA came in at $265 million — Twitter is predicting it will decline to $215-$235 million in the next quarter.

That profit was above analyst forecasts of $70 million but, following Facebook’s epic crash this week, investors want to see growth potential… and that means more users. Unfortunately, that’s Twitter’s Achilles heel.

[gallery ids="1681441,1681442"]We’ll have more to follow soon…

from TechCrunch https://ift.tt/2LUpXxN

via IFTTT

No comments:

Post a Comment