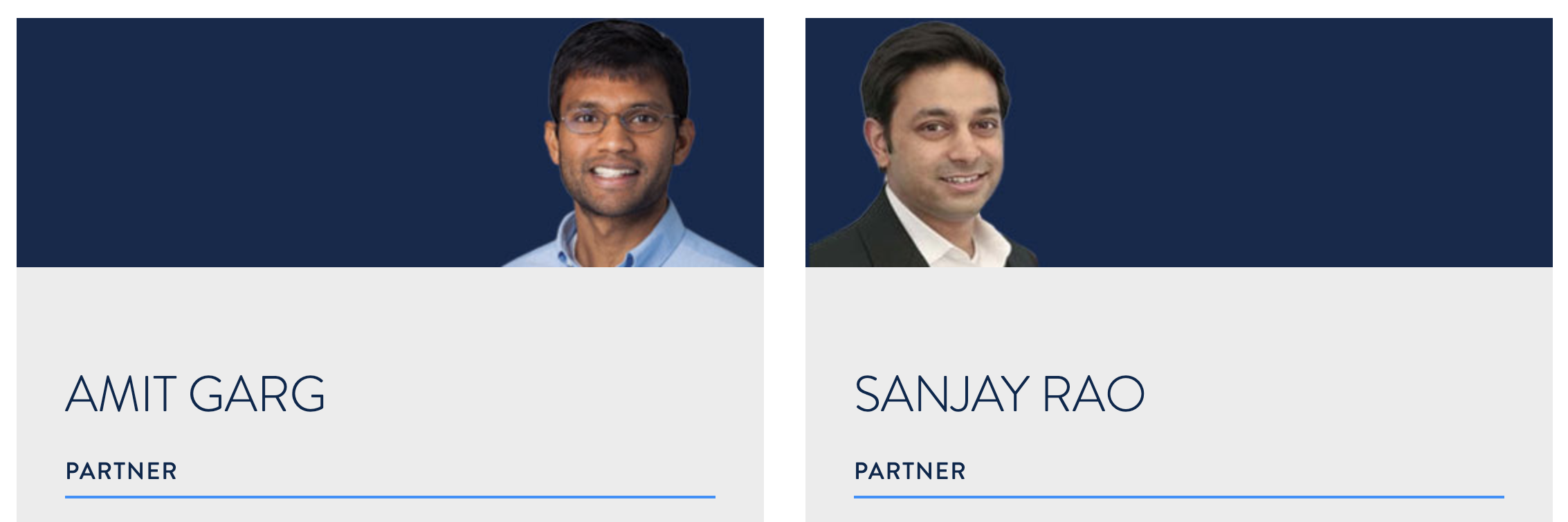

Amit Garg and Sanjay Rao have spent the bulk of their professional lives developing technology, founding startups and investing in startups at places like Google and Microsoft, HealthIQ, and Norwest Venture Partners.

Over their decade-long friendship the two men discussed working together on a venture fund, but the time was never right — until now. Since last August, the two men have been raising capital for their inaugural fund, Tau Ventures.

The name, like the two partners, is a bit wonky. Tau is two times pi and Garg and Rao chose it as the name for the partnership because it symbolizes their analytical approach to very early stage investing.

It’s a strange thing to launch a venture fund in a pandemic, but for Garg and Rao, the opportunity to provide very early stage investment capital into startups working on machine learning applications in healthcare, automation and business was too good to pass up.

Garg had spent twenty years in Silicon Valley working at Google and launching companies including HealthIQ. Over the years he’d amassed an investment portfolio that included the autonomous vehicle company, Nutonomy, BioBeats, Glooko, Cohero Health, Terapede, Figure1, HealthifyMe, Healthy.io and RapidDeploy.

Meanwhile, Rao, a Palo Alto, Calif. native, MIT alum, Microsoft product manager and founder of the Accelerate Labs accelerator in Palo Alto, Calif., said that it was important to give back to entrepreneurs after decades in the Valley honing skills as an operator.

Image credit: Tau Ventures

Both Rao and Garg acknowledge that there are a number of funds that have emerged focused on machine learning including Basis Set Ventures, SignalFire, Two Sigma Ventures, but these investors lack the direct company building experience that the two new investors have.

Garg, for instance, has actually built a hospital in India and has a deep background in healthcare. As an investor, he’s already seen an exit through his investment in Nutonomy, and both men have a deep understanding of the enterprise market — especially around security.

So far, the company has made three investments automation, another three in enterprise software, and five in healthcare.

The firm currently has $17 million in capital under management raised from institutional investors like the law firm Wilson Sonsini and a number of undisclosed family offices and individuals, according to Garg.

Much of that capital was committed after the pandemic hit, Garg said. “We started August 29th… and did the final close May 29th.”

The idea was to close the fund and start putting capital to work — especially in an environment where other investors were burdened with sorting out their existing portfolios, and not able to put capital to work as quickly.

“Our last investment was done entirely over Zoom and Google Meet,” said Rao.

That virtual environment extends to the firm’s shareholder meetings and conferences, some of which have attracted over 1,000 attendees, according to the partners.

from TechCrunch https://ift.tt/32fIcXR

via IFTTT

No comments:

Post a Comment