Future Positive Capital, an early-stage VC firm co-founded by ex-Index Ventures associate Sofia Hmich, breaks cover today. The new pan-European fund, which has a first close of $57.1 million, will invest in “deep tech” startups right across the region that are attempting to solve “the world’s most pressing problems”.

Specifically, Hmich and her co-founders Alexandre Terrien and Michael Rosen are seeking entrepreneurs using advances in artificial intelligence, robotics, synthetic biology, genetics, and other deep technologies to address global problems such as how to feed the growing population sustainably, how to tackle climate change, and how society will cope with an ageing population.

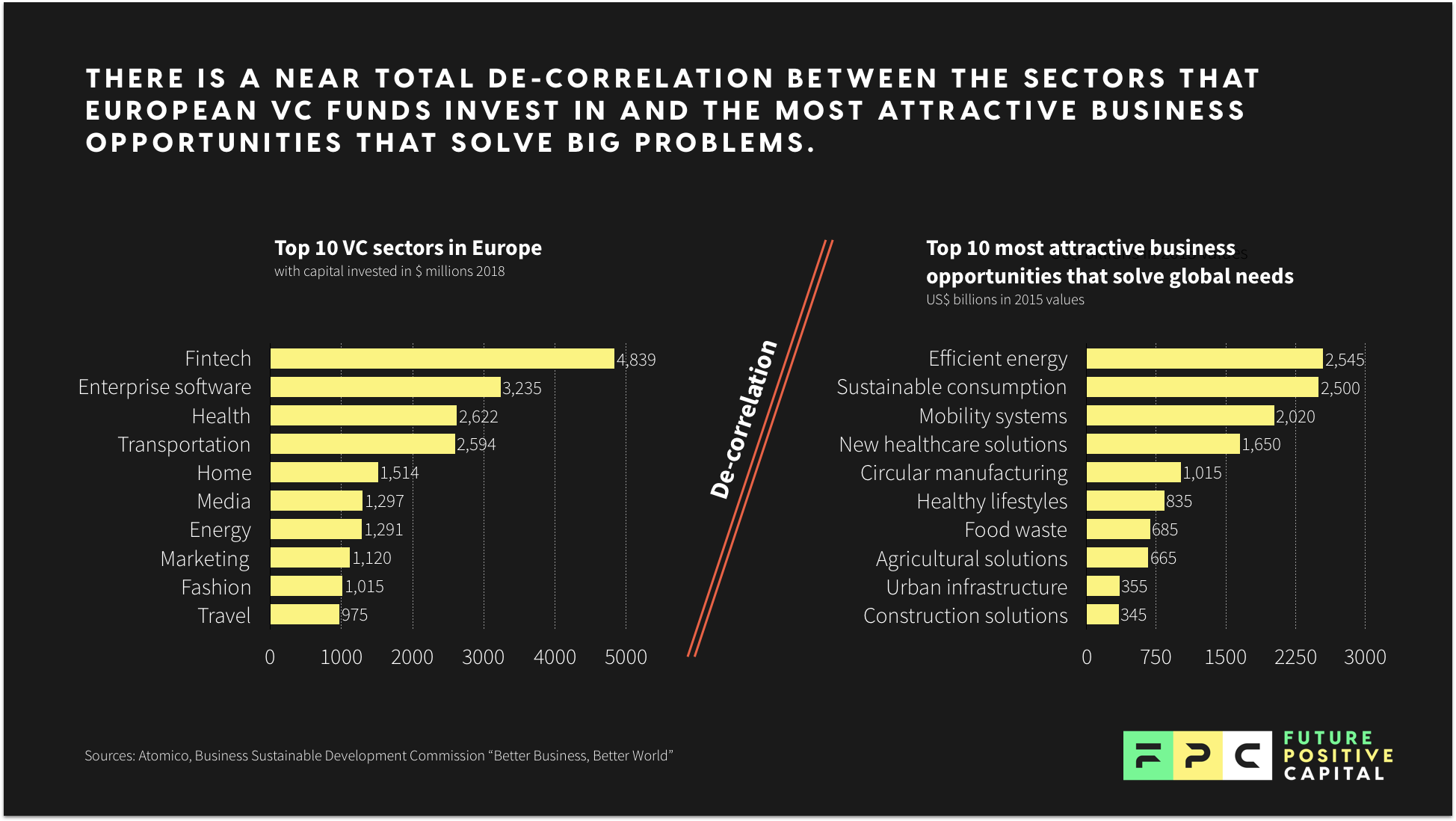

More broadly, the Paris and London-based VC firm is working from an investment thesis which argues that too much venture capital remains highly concentrated in a handful of sectors, such as consumer, fintech, and marketing, and focuses on web and mobile technologies that target mainly “upper class demographic groups”. And because of this there is a “long tail” of investment opportunities for investors willing to back a new generation of entrepreneurs building businesses that want to solve global problems that are in need of solutions, fast.

Coupled with this, Hmich says we are seeing a number of changes — such as the acceleration of advanced technologies, new aspirations from the workforce and consumers, huge macro demographic shifts and stronger regulation — which has led to a “tipping point” in the global economy that’s creating the conditions for these new types of companies to thrive.

Of course, it could also be argued that the Future Positive Capital thesis broadly contains ideas that many venture capital firms are now leaning more towards, not least because a lot of the lower hanging fruit has already been picked. However, Hmich insists that in Europe at least, having an early-stage VC solely dedicated to these types of startups is quite rare if not unique.

Out of this first fund, Future Positive Capital says it will build a portfolio of 20 to 25 investments at seed and Series A, and has a strong capacity to follow-on at Series B. Investments will range between around €300,000 and €5 million.

Backers of the fund include institutional investors such as Bpifrance, Draper Esprit, the European Investment Fund and Isomer Capital. It also counts a number of individual investors including Walter Butler, Henri de Castries, Marie Eriksson, Robin Klein and Francois Lemarchand.

Meanwhile, Future Positive Capital has quietly done two investments. They are BioBeats, an AI company focused on delivering preventative mental health, and Meatable, which is developing the “next-generation” of lab-grown meat (I was unaware the first generation of lab-grown meat was done yet, but I digress…).

Below follows an email Q&A with Future Positive Capital co-founder and General Partner Sofia Hmich, where we discuss the new fund’s remit, why Future Positive Capital says it is different from other European funds in terms of the companies it wants to back, her criticism of the status quo in venture capital, and why now is the time for a new VC fund like Future Positive.

Future Positive Capital plans to invest in startups at seed and Series A, with capacity to follow-on at Series B. Investments will range between ~€300,000 and ~€5m. Can you be more specific regarding the types of companies, technologies, business models or sectors you are focussing on?

The thing that really sets Future Positive Capital in motion is the new wave of entrepreneurs we’re seeing across Europe. These are people who are bold, long term thinkers, and who are using advances in deep tech fields like artificial intelligence, robotics, synthetic biology, and genetics, to build businesses aimed at solving large systemic challenges.

At the same time, while the solutions we invest in are diverse, we look for a common backbone in all our target companies – one that we feel represents a more holistic view of how value is created today. This revolves around four key components that, in our view, all reinforce each other: (1) business value, best represented by the creation of new markets, (2) scientific value, by way of proprietary technologies, (3) societal value, generated by solving global, complex and urgent problems, and (4) human value, via founding teams who have anticipatory visions of the future.

I wrote a blog post on our investment thesis to further explain this framework, but you can see this focus come to life in our first two investments: Meatable, a Dutch company developing in-vitro, lab-grown clean meat from stem cells, and BioBeats, an Oxford-based company that built the world’s first unified computational model for well-being. We’re absolutely thrilled to support these teams, and many more like them to come.

In your thesis you talk about a new wave of entrepreneurs who are focused on building businesses that solve the world’s biggest problems via advances in artificial intelligence, robotics, synthetic biology, genetics. Can you elaborate a bit more on what those big problems are?

Sure and I think it helps just to frame this by considering the size of the market opportunity that those big problems represent since people are often surprised by this: we are talking about a collective ~$12 trillion annually by 2030. Putting that into perspective, that’s 10% of global GDP!

Within that, we’re currently particularly interested in environmental technologies (water management, CO2 extraction from the environment, “ocean” technologies..), sustainable construction (higher energy efficiency, next-generation building management…), sustainable manufacturing (new materials development, transformative recycling solutions/circular manufacturing…), assistive technologies (for elderly as well as disabled people) and technology-enhanced business models that foster more responsible consumption by consumers and businesses. We’re of course open to the broad spectrum of opportunity that exists here, but for now these are the areas we’re especially excited by.

At the same time, you are quite critical of the status quo in venture capital, and seem to be arguing that too much capital is chasing the same narrow set of ideas and solving problems for a narrow “upper middle class” demographic. In particular, I want to highlight one line from your thesis: “capital remains incorrectly distributed across the spectrum of opportunity”. What do you mean by this?

In our view, the European venture capital industry remains quite concentrated in terms of technologies, sectors, and demographic targets, as seen in the chart below, which leaves a funding gap for advanced tech companies solving the world’s most pressing challenges:

In Europe, only about 17% of venture capital is deployed in deep tech. This is a stagnant number — a mere 0.5% increase over last year — with most of it in gaming or AI for the more traditional VC sectors of fintech and enterprise software.

By backing a concentrated set of technologies that in turn serve a smaller range of sectors, we’ve ended up with highly-capitalized companies focused disproportionately on “top of the pyramid” urban consumers who are tech-savvy and have established purchasing power. Now, I am not saying that we’ll dismiss companies whose traction come from this demographic group but the missed demographic opportunities and unaddressed demographic needs are enormous: by 2030, 1 billion people will be older than 65, and the global middle class will triple from 1.8 billion to 4.9 billion. Layer onto that the increasingly nuanced and empowered groups of consumers defining their own identity through their values or beliefs… and what you have are demographic changes of gargantuan proportions that will inevitably shift global demand.

They’ll be VCs reading this — and to some extent I would have sympathy with them — who’ll say that given the spaces that are left and that venture capital only really works by going after global problems at scale, your USP isn’t actually as unique as you are perhaps claiming. Isn’t it true that lots of VCs are already shifting their investments thesis into a similar direction as Future Positive Capital?

It’s absolutely true that some investors are moving in this direction, which we’re delighted to see!

While this is happening in the US already, with established firms like Lux Capital and new funds like OSFund making these investments, there currently isn’t enough funding to support the fast growth of these companies in Europe, and as a result, they tend to partner with strategic investors, foreign investors, or family offices. At most, funds here might have one or two investments in their portfolio that fit our thesis, but they are not yet systematically, and exclusively, investing in the kinds of companies we’re focused on.

That said, we’re confident that Europe has what it takes. With ~2 million scientists, our research community is the most prolific in the world, exceeding that of the U.S. and China. We’re energetically nurturing and developing the top of the talent funnel (we’re particularly excited to work with university initiatives like Oxford Sciences Innovation and the UCL Technology Fund and talent investors like Entrepreneur First). And we’re gaining recognition by investors and acquirers, with China investing 9x more in Europe than in North America in 2017!

Which brings us to timing: Why launch Future Positive Capital? Perhaps you can share a bit more of your thesis on why the timing is right for this kind of fund.

We’ve reached a tipping point in the global economy, which sets the stage for our target companies to thrive.

To start, we’re facing a radical shift in the aspirations of the workforce. People are seeking purpose over pay, and it’s the companies with the boldest missions that attract the best talent, giving them the best shot at transforming themselves from small businesses with big aspirations to global category leaders.

Additionally, we’re seeing an increasing universalization of challenges, where problems that once were those of “others” (i.e., the effects of climate change, poverty, etc.) have become those of everyone, and feel more pressing than ever. Even governments are increasingly focused on solving these problems through both incentives and regulation. Think about the moves China is making to reduce meat consumption by 50%, for example, or how Horizon Europe’s mission areas, announced last month, include “adapting to climate change,” “healthy oceans,” and “soil health and food.”

This is why the timing for this kind of fund is right – based on our conviction that the greatest value creation today will be driven by companies that necessarily improve the human and planetary condition.

You have previously said that by looking for blind spots to invest in, you also want to see Future Positive Capital invest in a more diverse set of founders. Does this mean you are planning to look beyond the “usual suspects” and hopefully begin to address what I call in the UK: tech’s McKinsey-Oxbridge problem?

Haha, I should be careful here given we backed a few entrepreneurs with this background!

Of course, if the founding team lacks diversity in terms of gender, ethnicity, social demographics, or lived experiences… or whatever is relevant to the problem they are solving, it raises a red flag. Only by developing what I call “multi-diversity” can organisations reflect the rich fabric of society, and teams understand the complex challenges of our time.

That said, we are less focused on resumes/profiles than on a few (rare) traits of character, and in particular, we look for individuals who thrive in uncertainty. Not simply “resilience,” but a mix of extreme perseverance with a desire and capacity to grow constantly. These people have the right agility to shift strategy when needed, a tireless capacity of execution, and a drive that can be – at times – scary, but always used as a positive force.

On that note, let’s talk deal-flow. How are you planning to generate enough and the right kind of deal-flow to ensure you get to see the types of very specific companies you want to invest in?

There is more deal-flow out there than we can process, so quantity isn’t our main challenge. Instead, we’re focusing our efforts on finding companies that truly fit our thesis. Though all entrepreneurs are of course welcome to contact us directly, we hope they approach us with a robust understanding of the types of companies we invest in.

To that end, qualified and relevant deal-flow often comes from founders who have attended our Future Positive Meetups (events that we organise every 1-2 months in Paris and London), our advisors and our community of Future Positive Catalysts (a group of 100 scientists, entrepreneurs, and other leaders who support our portfolio companies as needed), and, of course, entrepreneurs in whom we have invested historically.

Finally, you are officially the new VC kid on the block. What is the one thing you hate seeing other VCs do that you hope Future Positive Capital will never find itself doing either?

Following, instead of building our own solid convictions.

A data point that has really stuck with me is how much of the exit value in European technology is non-VC backed, between 50% and 70%, yet at the same time, there’s an increasing concentration of capital on the same number of deals. I believe these numbers are linked, and this “herd mentality” is why so many opportunities go unseen.

Capturing today’s biggest opportunities requires going back to the original mission of the founding entrepreneurs of venture capital – to invest in visionaries imagining a wildly different future – with an updated definition of value that reflects the changes restructuring our economy and societies. Our success will depend on staying true to this commitment.

from TechCrunch https://tcrn.ch/2KaHgN8

via IFTTT

No comments:

Post a Comment